The ASX200 slipped -0.4% on Monday with weakness in the influential banks and resources stocks dragging the market lower e.g. Commonwealth Bank (CBA) and BHP Group (BHP) both fell -0.7%. The sentiment deteriorated throughout the day with US futures falling in tandem with general selling towards China as protests around Xi Jinping’s Covid-zero policies gathered momentum e.g. the Hang Seng -1.6%. To put things in perspective the state media are even censoring the soccer World Cup to avoid showing spectators not wearing masks, and the knock-on impact of the civil unrest is being felt across a number of financial markets.

- Commodities have fallen sharply as the world’s 2nd largest economy moves from lockdown to lockdown e.g. crude oil has already fallen well over -30% from its June high.

- Apple Inc (AAPL US) is now expected to lose 6 million iPhone Pros due to problems at its plant in China i.e. a decade ago everyone wanted China exposure, but not today!

Attempting to 2nd guess the impact of public disorder in China is a far tougher call than a game of “Two-up” especially when we recall that the Hang Seng fell over -20% the day after the tanks rolled into Tiananmen Square – we take so much for granted in Australia. Our “Gut Feel” is a global slowdown attributable to China is close to being fully baked into markets especially when we consider that lockdowns across China are nothing new but we must recognise protests are a new dimension that could send stocks lower, at least in the short-term.

- Commodities appear to be oversold but equities haven’t followed them lower increasing risks for the Resources Sector e.g. copper and oil bounced strongly after sharp losses earlier yesterday.

US equities fell around -1.5% overnight following the weak lead from China, the selling was broad-based with all 11 sectors falling with Real Estate -2.8% the worst performer and Consumer Staples -0.3% being the best. The SPI Futures are actually pointing to a flat open locally helped by BHP Group (BHP) which rallied ~50c in the US in $A terms.

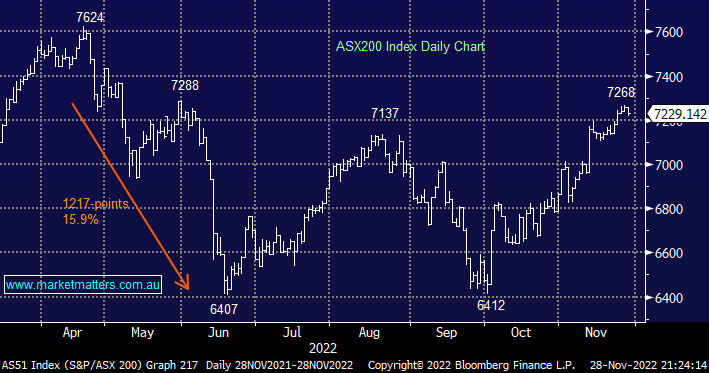

- MM is cautiously bullish on the ASX200 into Christmas but we feel the “easy money” is behind us unless we see a sharp dip towards 7150.