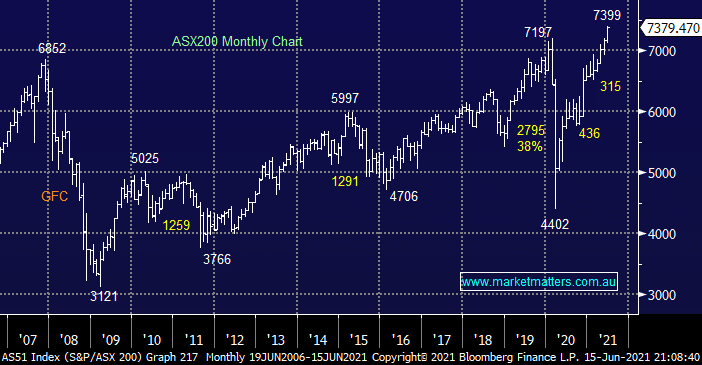

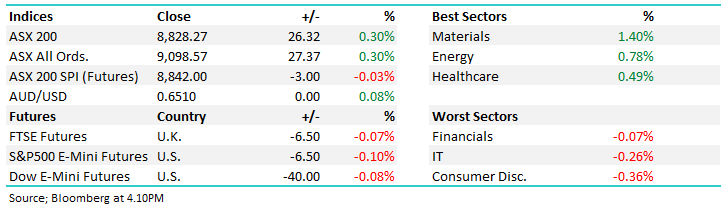

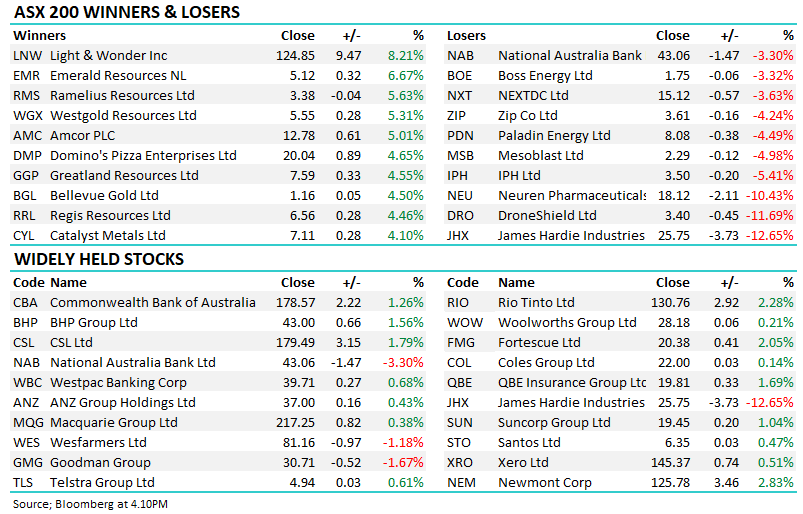

The ASX200 continues to rally steadily with the index challenging the psychological 7400 area in the early afternoon as the +0.9% gain took Junes advance to +218-points / 3%, and we’re still only half way through the month, although I would caution the bulls that we’ve reached MM’s target for June assuming the markets going to maintain the same momentum of the last 4-months. Mondays rally wasn’t particularly broad based with less than 60% of stocks advancing but when the banks re-join the party plus the large cap resources & CSL Ltd (CSL) are all in the winners enclosure its always likely to be a good day for the bulls.

The obvious catalyst for yesterday’s strong advance was all onshore with overseas indices trading mixed, the RBA in its latest minutes maintained a very accommodative tone which when combined with the ongoing dearth of sellers sent local stocks soaring, the key takeout’s to MM from the RBA were:

- The RBA acknowledged the economic recovery was stronger than expected but they still don’t intend to raise interest rates until inflation can be maintained between 2 & 3%.

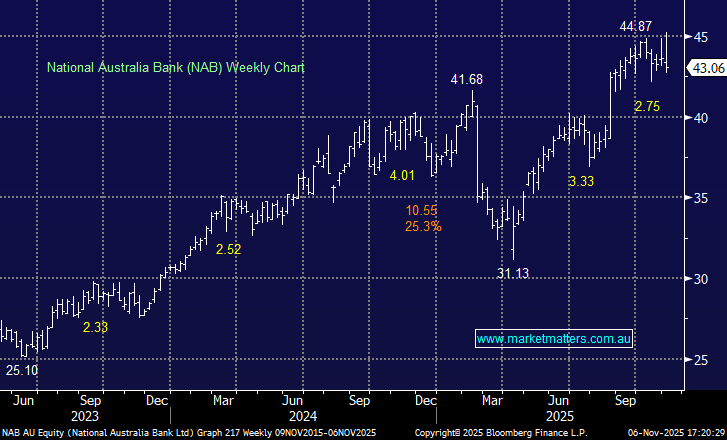

- The subsequent read through being the official cash rate is unlikely to be increased from 0.1% until 2024, at the earliest – perhaps the banks have raised too early.

- Julys meeting is all about whether they maintain the 3-year bond rate at 0.1% until November 2024, or do they again kick the can further down the road.

- Policy appears to have gone from an “if to a how” the RBA implements some degree of QE3 with a number of options available to Philip Lowe et al.

The RBA Governor will make a speech at 10.30am on Thursday titled “From Recovery to Expansion” which will be listened to very intently by most market players including ourselves. The prospect of some degree of QE3 sent stocks up and the $A down but if there’s any clear indication that 3-year bonds will be anchored to 0.1% into 2025 and beyond yesterdays rally might pale into insignificance.

Overnight we saw US stocks drift lower with the S&P500 closing down -0.2%, the SPI Futures are calling the ASX200 to open down around 10-points.