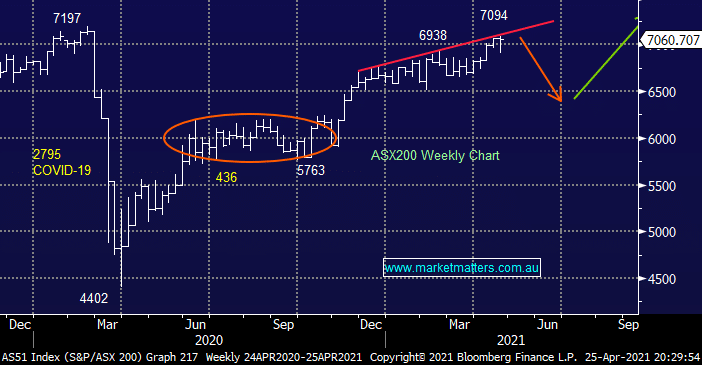

Last week saw the ASX200 close basically unchanged although it was fairly choppy from a day to day perspective but with Healthcare stocks picking up the slack in IT and Energy the net result to the index was extremely small. Stock / sector rotation continues to dominate the Australian market as we approach the infamous May – the phrase “sell in May & go away” is founded on hard seasonal facts – over the last decade, while the market was rallying, the average return for May was -3% and June -1.7%.

The COVID news from India continues to spiral out of control as it borders on the inconceivable with over 1 million fresh cases announced over just the last 3-days, the combination of sheer weight of numbers and 2 or 3 new mutations could easily cause a wobble in equities if / when it considers the risks to the much anticipated global economic recovery – India’s still supposed to enjoy double digit growth this year! However at this stage the influence of central banks huge stimulus is still keeping investors bullish as any dip is bought with ongoing enthusiasm but if pockets of COVID continue to deteriorate its hard not to imagine a deeper pullback on the horizon.

Elsewhere market news was fairly thin on the ground as ANZAC Day was front and centre on most peoples mind and heart. Property’s that did go under the hammer this weekend continued to sell above expectations although I sense a feeling of consolidation creeping into people’s mindset after the recent incredible gains – note I didn’t say fall, just time for a rest.

Fridays session in the US again saw all-time highs for the S&P500 which unfortunately didn’t flow through to our SPI futures which are calling the ASX to open basically unchanged this morning, personally I think we will open a touch better but that’s what makes a market.