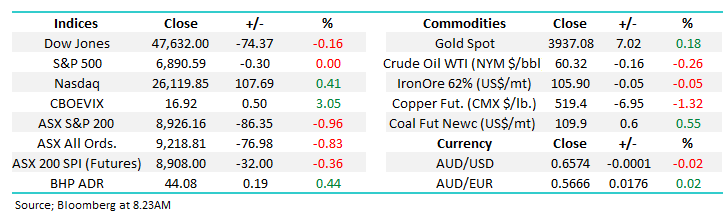

The ASX200 edged higher yesterday finally closing up 10-points after surrendering 2/3 of the day’s gains in the late afternoon, while the winners and losers were evenly matched it was a very interesting story of three commodities on the stock/sector level:

Gold: St Barbara (SBM) +9.1%, Evolution Mining (EVN) +6.6%, Northern Star Resources (NST) +2.6%, and Newcrest Mining (NCM) +2.6%.

Lithium: Pilbara Minerals (PLS) -2.9%, Core Lithium (CXO) -2.4% and Allkem (AKE) -1.6%.

Coal: New Hope Corp (NHC) -8.8% and Whitehaven Coal (WHC) -6.6%.

NB: Lead Portfolio Manager James Gerrish is hosting a Webinar with Resource Analyst Peter O’Connor on Wednesday 30th November at midday, discussing Coal, Gold & other commodities – Register Here

Following on from the above the last few days have shown some glimmers of performance reversion into the last month of 2022 but it’s certainly nothing conclusive at this stage:

- In the resources, as we highlighted above, money appears to be flowing from lithium and coal across to major laggard gold.

- Tech stocks are trying to rally while the banks are taking a well-earned breather.

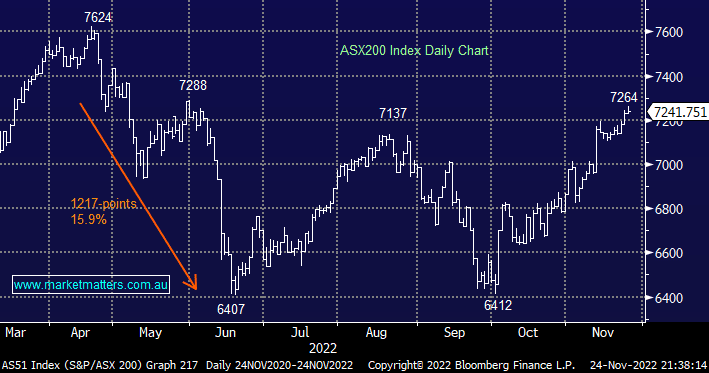

We will look at some of these stocks and their relationship later in today’s report but the overall index is still following the MM playbook as it rallies into Christmas with diminishing momentum – considering the index is now only 5% below its all-time high we find it hard to be overly excited as to how much further the market can extend on the upside but if we experience a sharp dip, as we did in the 1st week of November, it would look like a great short term opportunity for the very active/aggressive subscribers.

US stocks were closed overnight for Thanksgiving and while they are back on deck tonight, a very quiet session is expected. The $US fell under 106 and European equities advanced with the SPI futures pointing to a modest +0.2% gain this morning.

- MM remains mildly bullish on the ASX200 into Christmas but we feel the “easy money” is behind us.