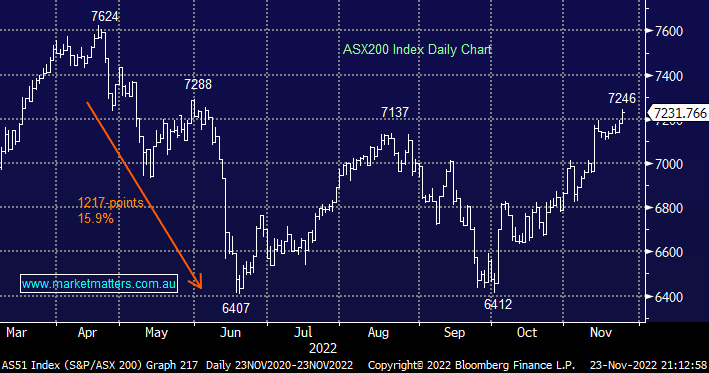

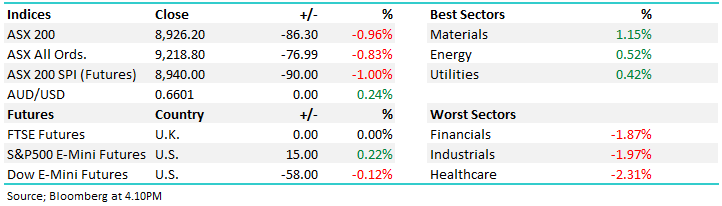

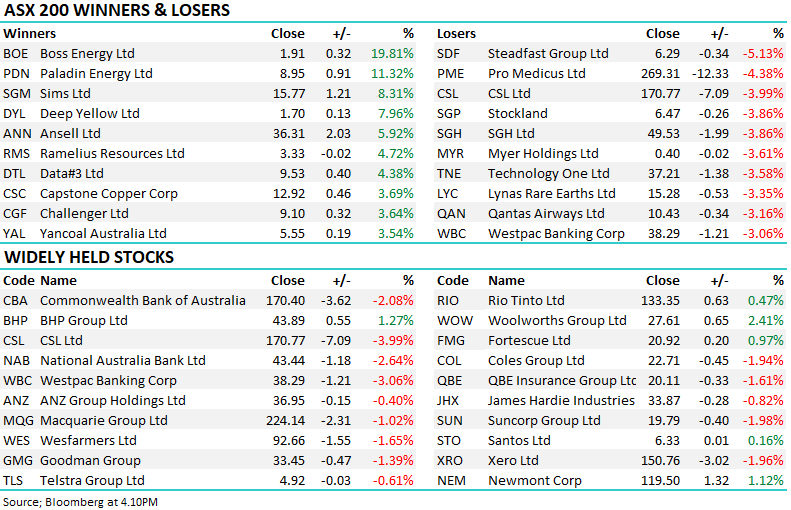

The ASX200 pushed up to test its June highs this morning, an impressive +13% rise from October’s panic low, it’s now surprisingly only 5.3% below its all-time peak – it certainly doesn’t feel like it in some pockets of the market. Heavyweights such as Commonwealth Bank (CBA) and BHP Group (BHP) have rallied strongly over recent weeks but numerous stocks remain in the “naughty corner” so far this quarter, and in 2022:

Down more than 25% YTD – GUD Holdings (GUD), ARB Corp (ARB), Reece Ltd (REH), Fletcher Building (FBU), SmartGroup (SIQ), Breville Group (BRG), Dominos Pizza (DMP), Credit Corp (CCP), Perpetual (PPT), Pinnacle Investment (PNI), United Malt (UMG), Bega Cheese (BGA), Healius (HLS), Sonic Healthcare (SHL), Nanosonics (NAN), Fisher & Paykel (FPH), Nickel Industries (NIC), Evolution Mining (EVN), James Hardie (JHX), Ramelius Resouces (RMS), Silver Lake Resources (SLR), Adbri Ltd (ABC), Domain Holdings (DHG), Seek (SEK), Nine Entertainment (NEC), REA Group (REA), Home Consortium (HMC), Mirvac (MGR), Goodman Group (GMG), Centuria (CIP), Ingenia (INA), Centuria Capital (CNI), Dexus (DXS), Lend Lease (LLC), Abacus (ABP), Charter Hall (CHC), GrowthPoint (GOZ), IRESS (IRE), Link (LNK), NEXTDC (NXT), and Kelsian (KLS) = 41 stocks or 20.5% of the ASX200.

Down more than 50% YTD – Reliance Worldwide (RWC), Magellan (MFG), Chalice Mining (CHN), St Barbara (SBM), Imugene (IMU), Megaport (MP1), Xero (XRO), and Novonix (NVX) = 8 stocks or 4% of the ASX200.

With plenty of stocks also down between 20 & 25% plus of course the major underperformers, such as Zip (Z1P), Janus Henderson (JHG), and EML Payments (EML) actually dropping out of the ASX200 the picture we are trying to paint is clear i.e. the advance back above 7200, and arguably within striking distance of the local markets all-time high, it’s not a classic healthy broad-based advance, the move has been very stock/sector specific.

- The rising interest rate cycle through 2022 has weighed heavily on many market sectors such as Diversified Financials, Consumer Services, Healthcare, gold, media, real estate, retail, and tech i.e. interest rate sensitive names.

If local stocks are going to push higher into Christmas it’s hard to imagine it doing so without any bargain hunting unfolding at some stage but it certainly hasn’t been evident of late. For some of the underperformers to at least bounce, some easing of the Feds hawkish rhetoric is probably required and that did show glimmers of hope in last night’s Fed minutes i.e. most policymakers expect a slower pace of rate hikes will “soon be appropriate”.

US equities rallied overnight after the release of the Fed Minutes with tech stocks leading the advance as bond yields and the $US drifted lower. The SPI Futures are calling the ASX200 to open marginally higher after yesterday’s solid performance with BHP Group (BHP) trading back above $44.50 in the US probably helped by the $US Index retesting the 106 area.

- MM remains mildly bullish on the ASX200 into Christmas but we feel the “easy money” is behind us.