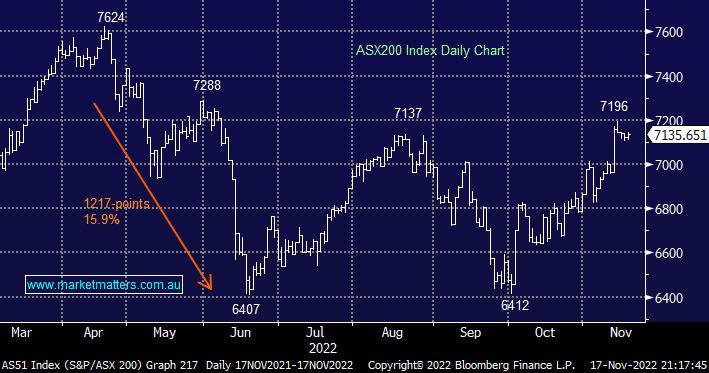

The ASX200 rallied +0.2% on Thursday with over 70% of the main board advancing, unfortunately, weakness across the influential resources stocks restrained a generally enthusiastic market e.g. Woodside Energy (WDS) -2.2%, BHP Group (BHP) -1.5%, Sandfire Resources (SFR) -3% and South32 (S32) -5.2%. It’s a touch boring but the story remains the same as the index starts to establish a small trading range between 7100 and 7200. On the stock and sector levels, it’s pretty quiet as December approaches fast, perhaps after a tough year so far fund managers are considering shutting up shop early with ~7100 feeling pretty good compared to early October.

One thing we would point out to investors becoming apprehensive about the local markets’ recent period of consolidation is that 3 of the “Big Four Banks” have recently traded ex-dividend and the ASX has taken this large payout in its stride i.e. ANZ Bank (ANZ), National Australia Bank (NAB) and Westpac (WBC). From a seasonal perspective, without wanting to get too micro, but it is quiet, the traditional rally doesn’t usually heat up until December so a degree of patience is probably warranted following the +12% rally since early October.

US equities experienced a muted session overnight with the S&P500 finally closing down -0.3%, not a bad performance after comments from Fed members sent yields higher – influential St Louis President James Bullard said he expects rates to rise to at least 5%. The SPI Futures are calling the ASX200 to open marginally higher with no obvious leads at this stage.

- MM still believes the ASX200 is bullish into Christmas but the “easy money” is behind us.