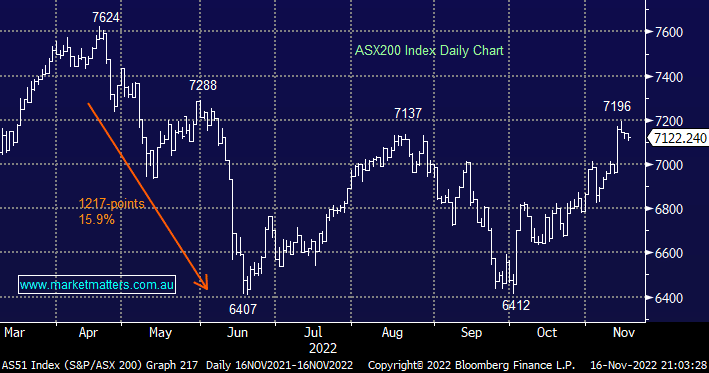

The ASX200 slipped for a 2nd consecutive day on Tuesday failing to embrace decent gains on Wall Street in the process, the banks were the biggest drag on the index with heavyweight Commonwealth Bank (CBA) dropping -1.8% although the broad market was weaker with almost 60% of the main board closing down on the day. The moves by CBA over the last 48 hours sum up the choppy nature of the current market, it advanced $1.38 on Tuesday before falling $1.90 on Wednesday i.e. it delivered a strong quarterly result on Tuesday but after surging +19.8% since July it simply feels tired on the upside.

- We believe the market remains solid into Christmas but many names like CBA have already rallied strongly & feel tired, we can see a classic “3 steps forward & 2 back” style advance with many stocks/sectors disappointing on the upside.

The markets have been following the MM script through most of 2022 and especially since its panic October low however the one sector that’s failing to listen to us is Australian tech e.g. yesterday the local tech names slipped -0.24% even following another strong performance by US Tech which gained +1.45%. I have seen this style of disbelief suddenly evaporate when least expected but for now, many of the local tech names continue to attract selling into any strength e.g. by the close yesterday the NASDAQ had bounced +15.2% from its October low while the local names have hardly rallied although we note local names didn’t plunge lower like US names last month.

- We remain patient with our bullish outlook for Australian tech into Christmas but it has been a largely frustrating few weeks towards these names.

US equities slipped lower overnight as a “Fed pivot” felt less likely following strong retail sales data which showed its largest increase in 8 months i.e. people are still spending as Christmas looms suggesting the economy can withstand higher rates. A couple of Fed speakers made some hawkish comments and Goldman Sachs now expects the Fed to increase its key rate to 5-5.25%, up from its previous call of 4.756-5%. The SPI Futures are calling the ASX200 to open down another -0.2% this morning following the down night on US indices.

- MM still believes the ASX200 is bullish into Christmas but the “easy money” is behind us.