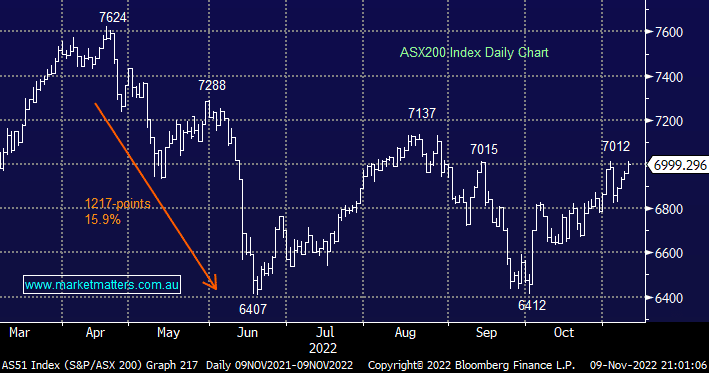

The ASX200 rallied another +0.6% on Wednesday basically closing smack on 7000 resistance but to adopt a corny often used phrase it was another classic game of two halves with well over 30% of the main index still closing in negative territory. Plus there were a few sectors such as Tech and Healthcare that sat on the fence, however as we’ve all seen this year the stocks /sectors could switch relative performance positions in the blink of an eye.

- Winners: Gold, oil, resources, and property.

- Losers: Coal, construction, media, and retail.

We’ve regularly discussed contracting cycles through 2022 however I think the last few days have set a new record:

- the Resources Sector soared higher on Friday (in the US) and early this week, hoping China would ease its Covid Zero Policy.

- the last 48 hours have seen stocks sent on a rollercoaster ride as Bitcoin tanked after the near-collapse of one of the world’s biggest cryptocurrency exchanges, FTX – more on this later.

- thirdly, this morning we’ve awoken to the results from the US mid-terms and their likely implications moving forward e.g. will we see another run for office by Donald Trump?

US equities fell 2% overnight as the post-midterm selloff gathered momentum, on a night that still hasn’t delivered a clear result on who will control congress i.e. as we know markets hate uncertainty. The market has enjoyed 3 consecutive up days on anticipation that the Republicans would perform strongly and be able to block any future tax and spending plans, it now remains too close to call. Markets and betting markets had been looking for a “red wave” which hasn’t materialised with volatility now likely to be the big winner. The SPI Futures are pointing to a 0.9% fall on the open this morning by the local market.

- MM still believes the ASX200 is set to test the 7200 area into Christmas with any surprises still likely to be on the upside.