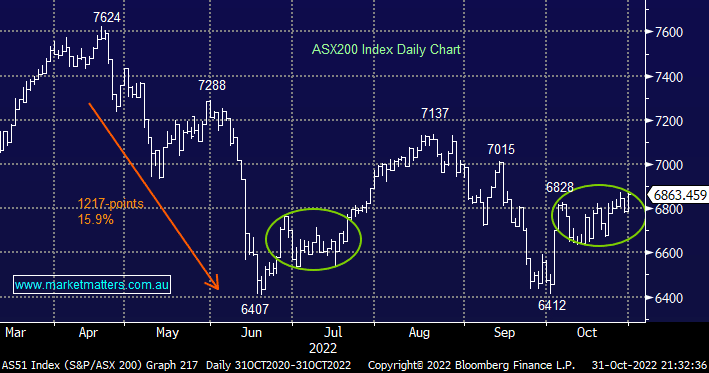

The ASX200 enjoyed a strong end to October rallying over 1% following in the footsteps of Wall Street on Friday night – the ASX200 ended the month up +6% as we now head towards the seasonally strongest period of the year. Outside of the Resources/Energy Sectors losers were fairly thin on the ground as only 20% of the main board declined on the day – the RBA’s rate decision today didn’t appear to unnerve too many investors i.e. a controlled rate rise is “old news”.

- The RBA is expected to hike interest rates by 0.25% at 2.30 pm today, just 30-minutes before the start of the Melbourne Cup.

- We believe another 0.25% hike will be bullish for stocks but if Westpac is correct and they go 0.5%, following the strong CPI inflation print, a kneejerk on the downside feels likely.

Interestingly, the RBA looks set to raise rates for a 7th consecutive time just as retail sales suggest things are getting tough for the Australian consumer. At MM we feel that Philip Lowe et al are keen to adopt a more dovish stance as they consider the lag effect on consumer spending plus of course the significant number of fixed rate mortgages switching to variable options later next year contracting people’s confidence/spending even further – we favour a 0.25% hike and equities rallying towards 6900 over the coming days as a consequence.

US equities drifted lower overnight with the S&P500 falling -0.75% but SPI Futures are pointing to a small rally by local stocks early this morning as we brace for the RBA and Melbourne Cup this afternoon – good luck to the punters out there

- MM still believes the ASX200 is set to test the 7200 area into Christmas.