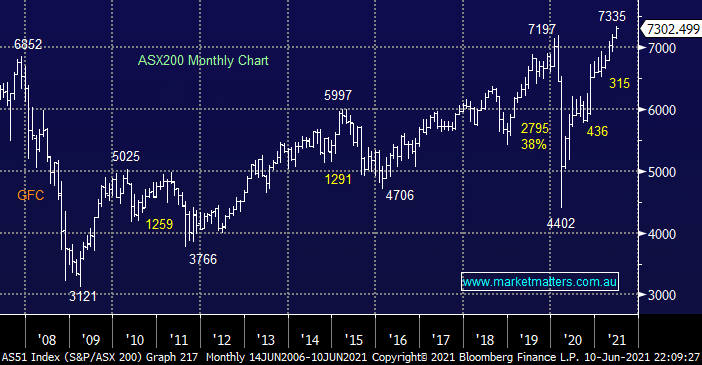

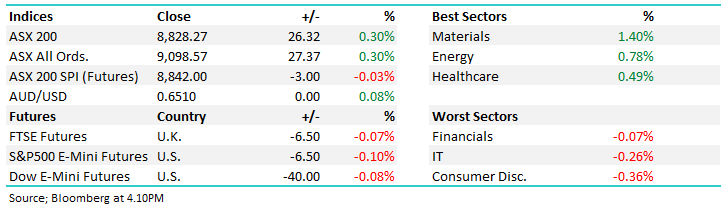

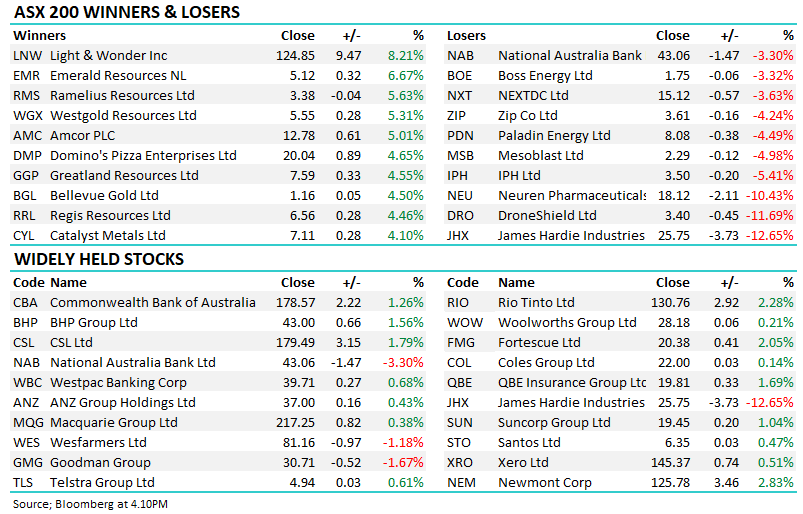

The ASX200 continues to hover around the 7300 area with stock / sector rotation still the main game in town, Thursday saw funds drift out of the banks and resources into the beneficiaries of lower interest rate such as IT, healthcare and real estate although most moves were fairly muted ahead of last night’s US inflation data i.e. at this stage its felt like there’s been some book squaring as opposed to major repositioning, only 1% of the market moving by over 5% yesterday illustrates the point. However after the relatively benign read through on last night’s inflation print this rotation back towards growth is likely to gather momentum.

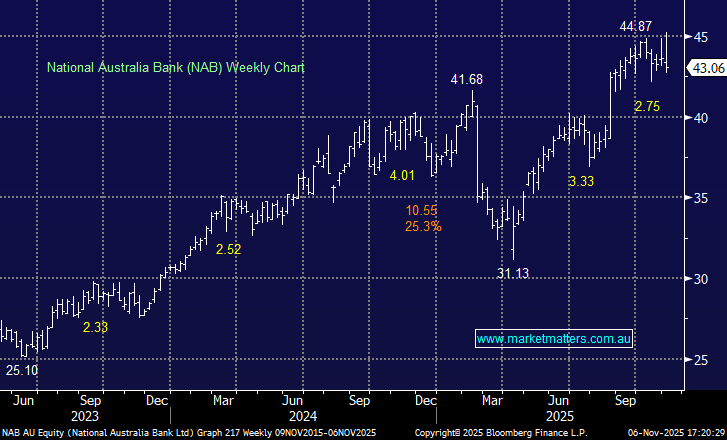

This view coincides with the recent drift in the second tier banks which suits our “leg in the air” stance towards the sector in our Flagship Growth Portfolio after we trimmed our positions in Commonwealth Bank (CBA) and National Australia Bank (NAB) on Wednesday from 10% to 7% in anticipation of allocating 6% into the Bank of Queensland (BOQ) around $8.50, or 5-6% lower. Its important to understand these levels are flexible and we will be monitoring day to day plus if we see a month or two where Bendigo Bank (BEN) noticeably underperforms BOQ it may become our preferred target. Last night’s interpretation around inflation numbers sent both US bond yields and the Financials lower last night which should help our cause.

US inflation jumped +0.6% for May, the 2nd biggest monthly increase over 10-years, this higher than expected number was fuelled by the reopening economy plus items such as second hand cars, airfares and apparel. However again bond yields looked through the current data and tumbled with US 10-year yields closing at their lowest levels since March of this year, this bullish move by bonds (when bonds rally yields fall) on strong data has been a characteristic MM has flagged over recent weeks.

Overnight global equities were mixed as growth stocks rallied strongly at the expense of value, in the US we saw the tech based NASDAQ rally over +1% while the Dow closed unchanged. The SPI is calling the ASX to open unchanged this morning which is not surprising with the large influence exerted on our index by the banks.