The ASX200 continues to climb a wall of worry closing up another +0.5% yesterday, well above the psychological 6800 level while also posting its best close in 6 weeks. The resources drove the market higher with heavyweights Woodside Energy (WDS), BHP Group (BHP), South32 (S32), and Newcrest Mining (NCM) all enjoying a good day at the office. If the banks had embraced ANZ’s result we could easily have seen ourselves challenging 6900 but for now, we’ll have to make do with an encouraging ~7% rally from this month’s low.

- The $US has appreciated over 20% in 2022, if it surrenders some of these gains in line with lower bond yields the Australian Resources Sector could significantly extend yesterday’s gains.

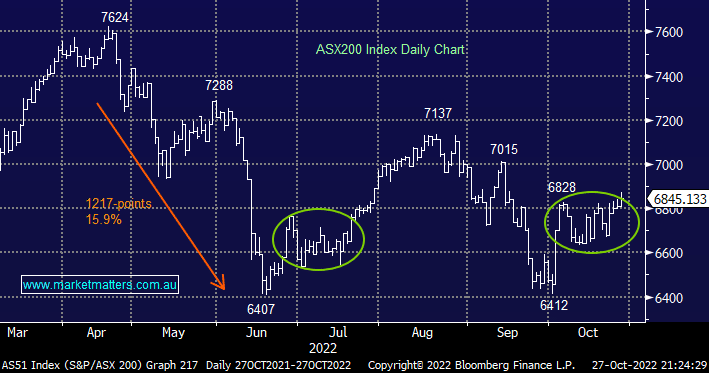

We’ve mentioned the local markets’ uncanny resemblance to its journey through June & July before it broke out on the upside, after Thursday’s move it feels like we’re set for round 2 and if the Fed & RBA behave next week we could be testing 7000 before investors know it while many people are still in cash thinking new lows into Christmas are inevitable:

- the RBA meets on Melbourne Cup Day with Westpac now forecasting a 0.5% hike to 3.1%, the other 3 of our big banks are looking for 0.25%, it appears that WBC was swayed by the latest blowout in inflation – no Christmas cheer on the horizon next year.

- the Fed meets on the 2nd of next week and is expected to deliver its 4th consecutive 0.75% hike, taking rates to levels not seen since 2007 but as recession fears increase this could be the last move of this magnitude.

Only back in June Fed Chair Jerome Powell said 0.75% moves were unlikely to be the norm yet here we are 4-months on expecting our 4th in succession which illustrates to MM how badly central banks have underestimated inflation after initially raising interest rates far too slowly. However, moving onto stocks we believe markets are factoring in bad news from both the RBA & Fed and while we believe they’re probably correct markets hate uncertainty and we can easily envisage them breathing a collective sigh of relief once both hikes are in the rear-view mirror and rallying higher hurting the numerous bears in the process.

US equities had a mixed session with the Dow rallying nearly 200-points whereas the tech stocks were weighed down by Meta Platforms’ ~24% plunge lower providing another example of tech stocks being punished when they disappoint i.e. 3rd quarter revenue fell 4.5% from the prior year, the last 2 quarters are the first time ever that the company’s sales have declined.

- MM still believes the ASX200 is set to test the 7200 area into Christmas.