The ASX200 rallied strongly yesterday following Wall Street’s lead on Friday night as opposed to the savage declines which rolled across Chinese-facing stocks as Xi Jinping took full control of the world’s 2nd largest economy. The local market may have closed up +1.5% but it still surrendered ~30% of its early gains as the Chinese stock market rout weighed on sentiment. However, there were some shining lights which caught our attention as over 85% of the market rallied:

- the IT and Materials Sectors both closed up over 2% led by the likes of Sandfire Resources (SFR) +4.5%, BHP Group (BHP) +2.6%, Xero (XRO) +4%, and Altium (ALU) +2.4%.

- however the gold stocks finally shone the brightest e.g. Evolution Mining (EVN) +7.7%, Regis Resources (RRL) +5.2%, and Northern Star (NST) +5%.

Conversely, Chinese dual-listed heavyweights tumbled in the US pre-market scarred by Xi’s tightening grip on the Chinese ruling party, a basket of 40 Chinese stocks including Alibaba Group and JD.com was down ~13% as the ASX closed. The panic selling on Monday which saw the Hang Seng plunge -6.4% was sparked by Xi packing the Politburo, which only reshuffles every 5-years, with his loyal disciples, effectively he has as much control in China as Putin does in Russia, a very sobering thought. For good measure, China imposed Covid curbs in the centre of Guangzhou, the factory hub of the country.

- Hong Kong’s index plumbed to its lowest level since 2009 as foreign investors dumped a record $2.5bn of mainland Chinese stock while at the same time the Yuan hit its lowest level against the $US in history.

We all thought Liz Truss was a disaster but it could be argued that Xi & Co are giving the already ousted PM a run for her money with their impact on markets. Unfortunately, we can see ongoing issues out of China well into 2023 but as we saw yesterday it’s not having too large an impact on the ASX at this stage of the cycle, however, if we continue to see economic contraction out of China it will become a significant headwind for the Australian Resources Sector – definitely, one to watch as we wait to see if / when the next stimulus button will be pressed although it makes no sense while they keep locking down cities.

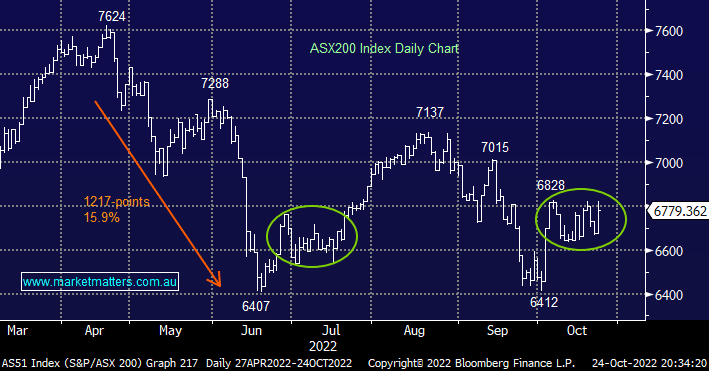

US equities rallied again last night as investors await the next batch of earnings numbers from the likes of Microsoft (MSFT US), Alphabet (GOOGL US), and Meta Platforms (META US), plus of course, we have the looming Fed rate decision. Traditional growth stocks, tech, and healthcare led the market higher as the S&P500 finished up +1.2% while the SPI Futures are pointing to the ASX opening up around +0.4%, back around the psychological 6800 area.

- MM still believes the ASX200 is set to test the 7200 area into Christmas.