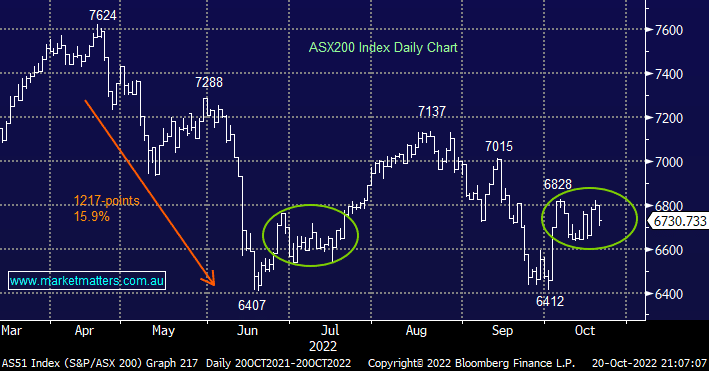

The ASX200 fell over -1% yesterday on broad-based selling which saw over 80% of the leading index close in the red, only the Energy and Financial Sectors managed to close up on the day. The local market continues to rotate in the 6625-6825 region and with the next Fed policy decision due in less than 2-weeks investors feel reticent to take equities towards a new level of equilibrium without fresh news – as we mentioned yesterday the current consolidation looks identical to the one we experienced through June / July before stocks eventually broke out on the upside.

- The breakout back on the 20th of July was courtesy of a +3.8% surge by the tech sector, MM is positioned for something similar in November, hopefully, history repeats.

The UK continues to deliver some fascinating headlines as Liz Truss’s battle to remain at Number 10, Downing Street has ultimately failed and now Boris Johnson is considering applying for his old job! However, the negative surprises out of the UK are having less impact on markets, the Pound remains well above its late September multi-decade low and equities actually enjoyed small gains last night. The FTSE is starting to look constructive after making fresh 2022 lows although like most stock markets it still doesn’t feel out of the woods just yet.

Closer to home China is threatening to release some market-friendly news for a change as reports circulate that authorities might reduce the Covid quarantine for inbound travellers, ironically only a few days after Xi Jinping lauded the country’s decision to maintain its zero policy dream. Perhaps the party is softening as Beijing cases hit a 4-month high for all their efforts and restrictions, I suspect there’s plenty of more bluster left on the subject with day-to-day news pretty meaningless.

US equities again found themselves surrendering early gains after further hawkish rhetoric out of the Fed sent bond yields higher taking the luster away from equities in the process. The SPI Futures are calling for the ASX200 to open down 25-points this morning following a sharp dip at 6.55 am.

- MM still believes the ASX200 is set to test the 7200 area into Christmas.