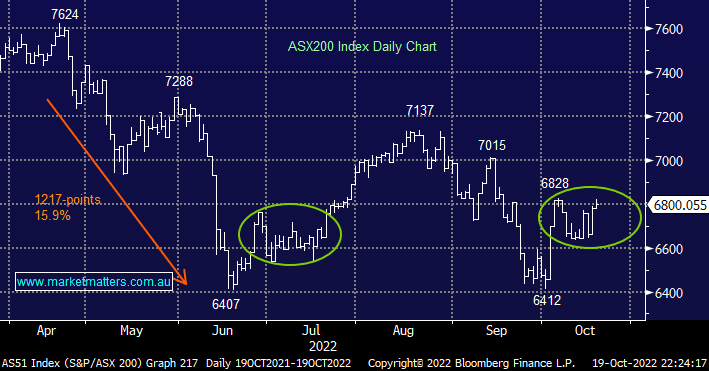

The ASX200 enjoyed another strong session on Wednesday to close the day up +0.3%, taking it back above the psychological 6800 level. Most of the action on a relatively quiet day unfolded on the stock level with the battery metal stocks bouncing nicely whereas one of MM’s holdings Megaport (MP1) was clobbered after failing to meet growth expectations, more on this later. We continue to feel the path of least resistance for stocks is on the upside as we approach the Fed’s interest rate decision in 2-weeks’ time and of course a potential “Christmas Rally” but as we keep saying on all levels it feels likely to be a choppy affair not indifferent to much of 2022. One statistic that an old colleague of mine posted on Twitter overnight in our opinion puts things into perspective:

- the ASX200 December Quarter has returned +2.9% since 1990 BUT when you strip out the losers it returns +5.8% – thank you, Nick Holt.

This quantifies that we’ve entered a strong time of year but it’s also important to reiterate that MM is looking for gains closer to twice the usual average although it’s easy to argue that the year’s losses make a larger spring back a reasonable ask. Interestingly the current price action is very reminiscent of what we recently in June / July but we believe it’s important investors don’t try and force views onto today’s market, position portfolios for what you believe comes next, and most importantly of all have an exit plan if the picture changes:

US equities enjoyed another choppy session finally closing down -0.7% with Energy the best performing sector while Real Estate dragged the chain. Not an awful performance considering that bond yields again scaled fresh highs for 2022 but it again illustrates the elephant in the room ahead of the Feds rate decision in early November. The SPI Futures are pointing to an early decline of -0.7 by the ASX200 moving in-line with the US.

- MM still believes the ASX200 is set to test the 7200 area into Christmas.