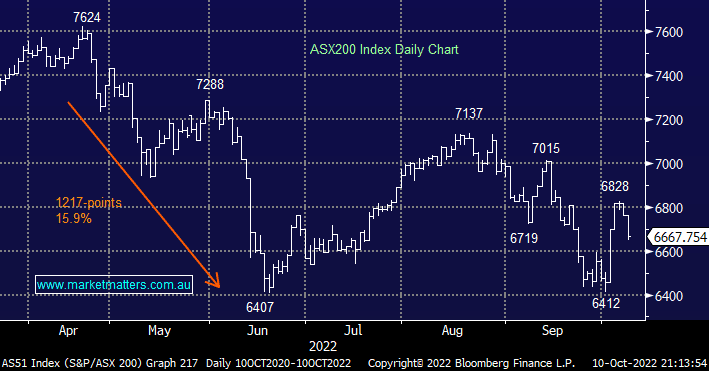

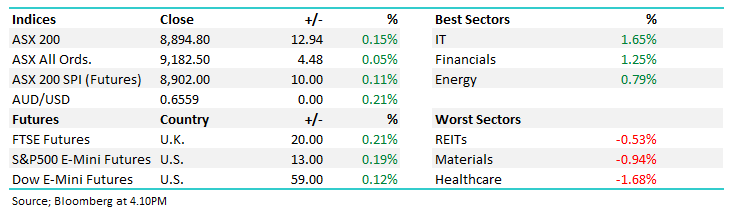

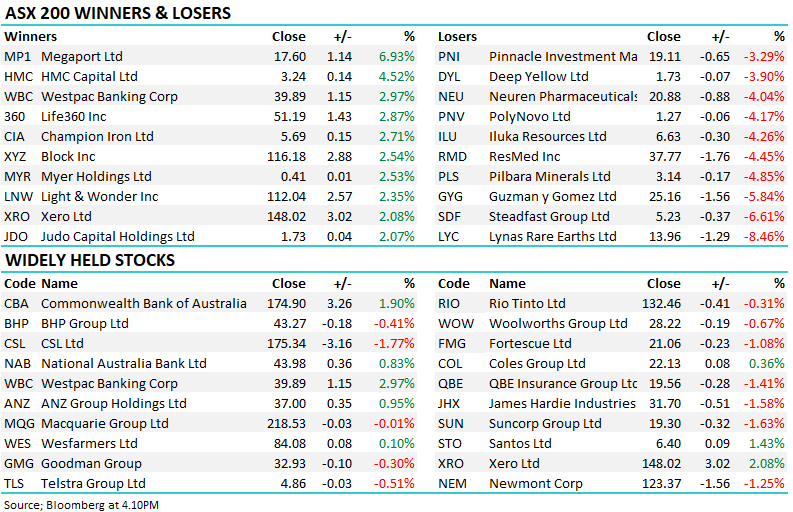

The ASX200 struggled yesterday following a poor night on Wall Street coupled with the S&P500 futures pointing to a very shaky start to the week for US stocks, the local index finally closed down -1.4% with over 90% of stocks closing in the red. As expected the growth stocks bore the brunt of the selling following the strong US Employment data on Friday night as they continue to dance to the bond yields tune i.e. rising bond yields continue to weigh on stocks and in particular the likes of tech.

Asian indices didn’t help market sentiment as China’s COVID cases rebounded ahead of Sunday’s 20th Party Congress, their housing market continues to tumble and Joe Biden extended China’s restrictions to American technology sending global semiconductors sharply lower. The Japanese Nikkei fared the best only slipping -0.7% but whatever region we scan good news is definitely thin on the ground and with the US CPI due on Thursday followed by the Fed’s next rate policy decision on the 2nd of November its hard to imagine any sustained buying until these major hurdles have been overcome.

NB: China’s Party Congress occurs every 5-years and it’s where the Communist Party decides who will run the country for the next half-decade, this month’s meeting looks set to see Xi Jinping receive a 3rd term which in theory means no fresh surprises.

The latest round of market volatility was largely expected by MM and while we believe global equities are looking for a low the major macro-economic news due over the next 3-weeks is likely to deliver yet another volatile October i.e. investors are already very unsettled before they have the proverbial kitchen sink thrown at them!

US equities experienced a choppy session overnight although it tried to shake off the barrage of headwinds which also included an escalation in the Ukraine war, but the sellers ultimately won the arm wrestle and the Dow closed down -0.3%. However, the SPI futures are pointing to a slightly better opening locally for the ASX after the local market clearly braced for another storm yesterday.

- MM believes the ASX200 is set to test the 7200 area into Christmas, after the latest dip now ~8% away.