The ASX200 had a quiet Thursday, especially when compared to the previous two sessions, the index closed up less than 2-points with losers actually slightly outnumbering the winners. Another strong performance by the Energy Sector managed to edge the index higher but outside of the likes of Whitehaven Coal (WHC) and Woodside Energy (WDS) it was a relatively uneventful trading day which felt at its most comfortable trading basically unchanged – no great surprise after already rallying +6.5% from Monday’s intra-day low.

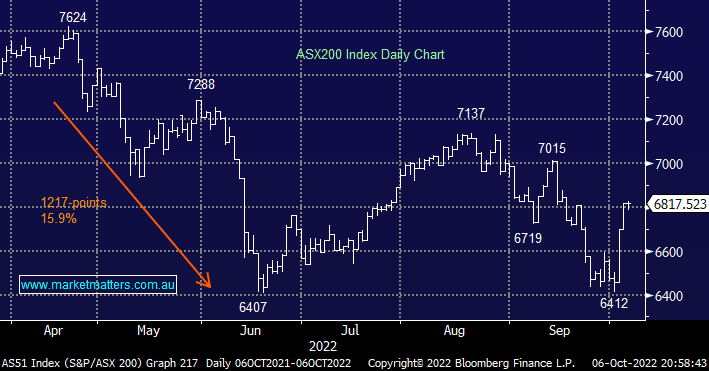

- As we highlighted on Thursday the local market is now trading in the middle of our anticipated 6400 – 7200 trading range hence plenty of rotation feels likely on the horizon.

The sentiment seemed to shift slightly yesterday after OPEC and friends flagged their intentions to cut oil supply which helped the Energy Sector but stoked inflation fears, there are undoubtedly plenty of more swings in the inflation–recession arm wrestle to unfold into Christmas. As many local bond traders were reminded this week 2nd guessing central banks is an extremely dangerous game and one that will probably hurt more players as the Fed looks set to hike rates either 0.5% or 0.75% on November the 2nd with the inflation release due out next Thursday the likely swing factor in this decision. Lower inflation (sub 8.1% YoY) and the smaller of the two in terms of rate hikes will likely send stocks higher but it’s hard to imagine too many investors getting bullish ahead of time, especially considering the recent hawkish rhetoric from the Fed.

- The Dow fell last night under the weight of further comments from Fed officials who reiterated their goal to unequivocally crush inflation with rate hikes – no sugar coating here!

- Also buyers were reticent to chase stocks higher ahead of tonight’s important unemployment figures out of the US that bond markets will be watching very closely for signs that higher interest rates are starting to work.

US equities haven’t yet regained their mojo in the same manner as our own and another decent dip for them wouldn’t surprise which by definition is likely to drag the local index lower – perhaps global equities want to see next month’s actions/rhetoric from the Fed before removing their bearish hats. Hence at this stage, we’re happy to run with “buy weakness and sell strength” mantra although from a practical perspective we are now long the market with a plan to reduce exposure into strength back towards the market’s recent August high.

- MM believes the ASX200 is set to test the 7200 area into Christmas, currently less than 6% away.

Some standout weakness that caught our attention yesterday was again experienced by some battered names of the last year which has seen an unforgiving market simply smash stocks that miss earnings expectations, especially if they’ve become a repeat offender.

- In bear markets as we’ve experienced through 2022 attempting to buy stocks “on the cheap” following a poor earnings report rarely pays off.

- More importantly if we’re already long and a company disappoints, the 1st loss will probably be the best loss – we’ve learnt this the hard way a few times this year!

The important lesson here is to recognise/acknowledge what cycle the market is in, especially when it’s bearish as it has been through 2022 i.e. “if in doubt get out” as the market is likely to sell off stocks more aggressively than many expect.

- Cutting losers with more vigour if they disappoint operationally / financially is a focus for MM.