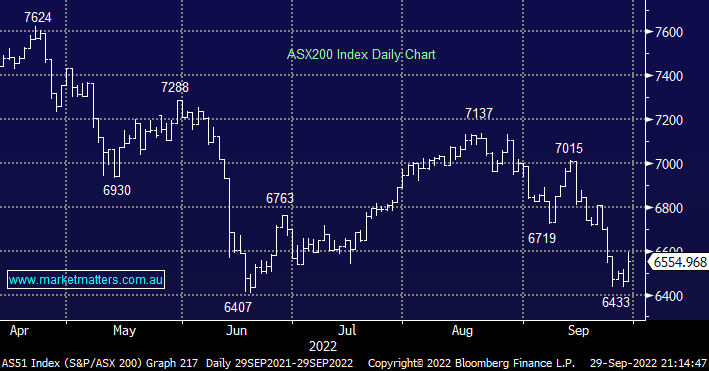

The ASX200 finally regained some of its much-needed Mojo yesterday finally managing to close up 92-points even after a sell-off into the close as US futures reversed sharply lower – again! Unfortunately, we remain confident that volatility will remain elevated into October but as we look through the noise MM is looking for ongoing signs that the market’s internal strength and the underlying sentiment are improving. Yesterday’s broad-based gains were a step in the right direction with well over 80% of the main board closing up on the day led by the resource stocks but with selling extremely thin on the ground we actually saw the index challenge the 6600 area early in the day.

The BOE was the catalyst for the improved market sentiment on Thursday, only a few days after the UK’s post-Boris Conservative Government crushed stocks by releasing a huge tax stimulus package, it’s now over 6-years since the surprise BREXIT vote but suddenly Britain has again become the focal point of financial markets – we believe this will be in the rearview mirror come November but a few more fireworks are likely from “Old Blighty” before she loses the limelight.

Subscribers know we are bullish into Christmas but after one-days bounce, we must keep our feet firmly on the ground – so far the markets only corrected a mere ~20% of the market’s plunge from August and from a technical perspective to become confident the tide has fully turned we would like to see the ASX200 close back above 6750, another 3% upside which feels a big ask at this stage of the game.

- MM believes the ASX200 is looking for / has found a low but we want to see a close above 6750 to receive technical confirmation that all looks good.