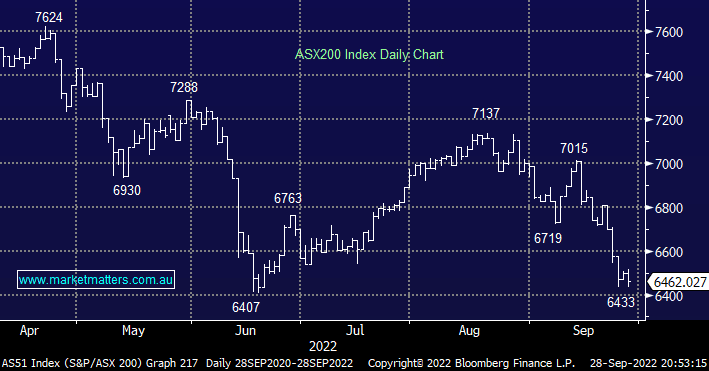

The ASX200 fell another -0.5% yesterday after trading higher in the morning only to be buffeted lower following comments from the Whitehouse which threw cold water on any potential currency intervention to cap the rising $US plus Apple (AAPL US) announced it had shelved plans to increase iPhone production due to faltering demand, the 2 pieces of news sent US Futures sharply lower, dragging the SPI and local stocks down in its wake. There’s no doubt that at the moment the Fed and most fellow central banks have little concern about the negative impact of their rhetoric on stocks. As we said on Wednesday morning “further news-driven turbulence feels almost guaranteed and it will be how the market deals with such events which is likely to determine if we are correct”:

- MM continues to believe that global stock markets are looking for a decent low but further volatility/weakness into the often feared October appears likely.

- Interestingly for all the bluster of October the average return of the ASX200 over the last quarter for the last 20-years is +2.8% whereas the average return through August & September over the same two decades is -1%.

Under the hood yesterday we didn’t see any standout moves, it was more of the same with buyers remaining rooted to the sidelines under the weight of ongoing bad news – there’s plenty of it! However, the local economy remains surprisingly buoyant with Australian Retail Sales rising +0.6%, well ahead of the +0.4% consensus but in today’s “glass half empty” environment, bearish investors simply focused on the increased likelihood that the RBA would hike by another 0.5% next week.

- We think the RBA will probably raise by another 0.5% next Tuesday but only just, a 0.25% hike wouldn’t surprise us due to the lagging impact on homeowners looming on the horizon.

The RBA will be looking slightly further ahead than yesterday’s strong retail sales number, they will be weighing up the repercussions from 60% of Australian mortgages being variable and 80% of fixed ones switching to variable through 2023, in other words, 90% of Australian home loans will be directly impacted by the overnight cash rate by the end of 2023 – not great news for an already weak property market.

- It’s a contrarian view but we’re bullish the ASX200 into Christmas believing the next +10% move will be on the upside – the overnight rally in the US is a start. I discussed this view with Alan Kohler yesterday on his podcast Talking Finance – Listen Here