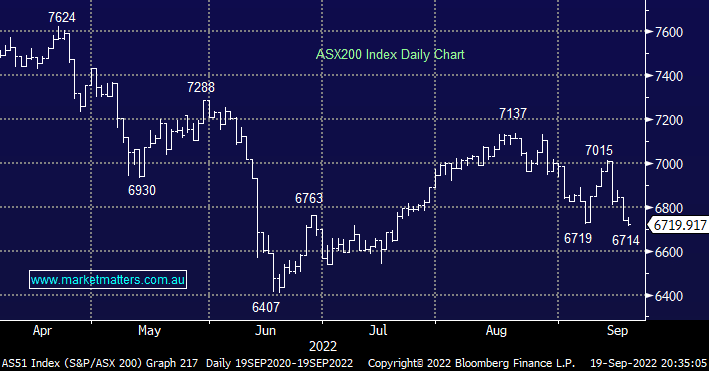

The ASX200 drifted lower yesterday on apparent nervousness ahead of this week’s US rates decision as economists weighed the prospect of a 0.75% move, or potentially a sledgehammer-style 1% rate hike – only a few months ago the idea of a 0.5% hike was foreign to investors now many believe it could be twice that amount! Markets are developing that self-fulfilling quiet before the storm feel about them before Wednesday’s decision, we’re still looking for buying opportunities but at the moment the path of least resistance remains on the downside.

Last week was one that most investors would like to forget and the moods unlikely to be aided by September’s reputation as seasonally the worst month of the year for US indices e.g. over the last 20 years the S&P500 index has ended September down -0.6% but there are a number of ways to improve this troublesome picture:

- The S&P500 had already fallen -2.1% for September (to the end of last week) suggesting things are already getting stretched on the downside.

- Over the last 20 years the S&P500 has rallied 4% through the last quarter of the year i.e. it’s approaching a great time to buy stocks from a historical perspective.

For the bulls like MM – at least into the end of the year, we stress there’s very little encouragement in the news today with talk of an imminent recession, ongoing rate hikes, problems in corporate America and of course inflation. However, as we keep repeating when everything’s so obvious markets rarely reward the crowd although where equities will finish their current leg lower is a tough call hence MM is simply buying on the back foot into the current weakness. There are a couple of other potential sticking points for stocks into October but they could go either way:

- October is usually the market’s most volatile month for stocks aided in 2022 by US midterms and of course 3rd quarter earnings.

- However the infamous October is also often referred to as the “Bear killer” as it often houses the low for stocks before a strong rally into Christmas.

The coming few weeks are likely to be volatile but we still believe stocks will be higher come Christmas Day.

US stocks reversed higher in the last hour overnight with the S&P500 closing up +0.7% with Apple Inc (AAPL US) rallying +2.5% catching our eye. Bond yields remained firm with the rate-sensitive 2-years testing 4%, again making 15-year highs, while the 10-years traded above 3.5% for the first time since 2011. The SPI futures are looking for a relief rally this morning with the ASX200 poised to open up around 50-points around 6775, we could have seen the month’s low already.