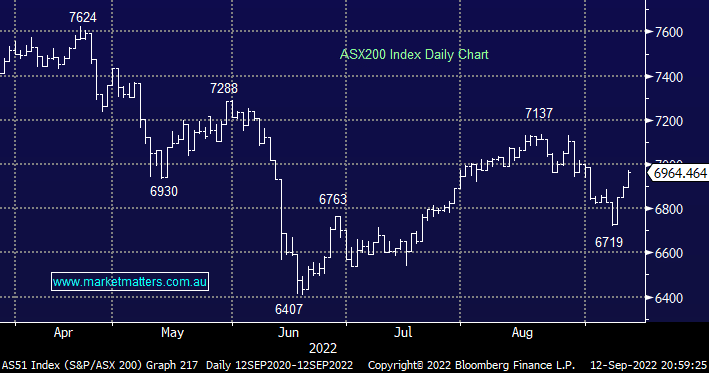

The ASX200 has enjoyed a strong start to the week with yesterday’s +1% taking the index back to almost unchanged for September following the major jitters early last week – in today’s market a week is clearly a long time! Buying was broad-based on Monday with well over 70% of stocks advancing led as was expected by the Resources Sector e.g. Sandfire Resources (SFR) +3.6% BHP Group (BHP) +3.5% and Fortescue Metals (FMG) +3.3%. There was some very interesting news out of Ukraine over the last 24 hours which the market seemed to largely ignore probably because it can be interpreted in a number of different ways:

- On the surface the recent Ukraine successes sound encouraging that an end could be in sight for this awful conflict which commenced way back in February, over 200-days ago.

- However if Putin survives potential internal strife he could be even more dangerous as he attempts to wrestle back the initiative after suffering a number of embarrassing defeats.

From an investment perspective it makes no sense to second guess what comes next from Eastern Europe, we must continue to look at companies and sectors we like into 2023 especially when in our opinion the market remains “too short / underweight” at least for now but we still believe our mantra for 2022 will stand investors in good stead well into 2023 although around 7000 were probably in “no man’s land”:

- MM continues to believe 2022 is the year to “buy the dips and sell the rips” but for the 1st time since the GFC we believe the emphasis should be on the sell side of the equation.

The US NASDAQ has illustrated the point perfectly having corrected -34% since November while managing to bounce +17% and +23% along the journey – these are big market swings over just 10 months caused by plenty of 2nd guessing on the macroeconomic front. However, while we believe this is an important dimension that can help with buy and sell levels in today’s sentiment-driven market MM is only interested in quality businesses at the right price as opposed to attempting to pick the next big short squeeze.

- Following last night’s broad-based rally by both US and European equities the ASX200 is poised to test the psychological 7000 area this morning i.e. up around 0.6%.