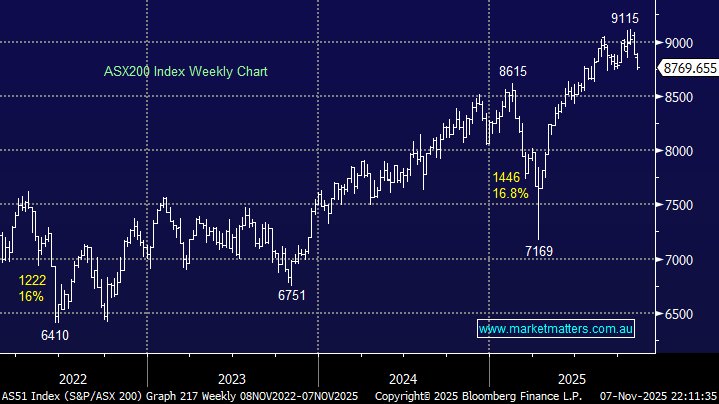

The ASX200 experienced broad-based selling on Thursday with less than 25% of the index up on the day but the market heavyweights helped avoid any meaningful weakness on the index level i.e. Commonwealth Bank (CBA) +1.4%, BHP Group (BHP) +0.7% and CSL Ltd (CSL) +2.3%. Thursdays -0.2% decline hardly made a dent in the market’s recent advance, again we saw the market rally well from its early lows reducing the losses by ~70% in the process as the path of least resistance is still clearly up!

Under the hood stocks/sectors are slowly starting to take notice of rising bond yields and while the moves are far from conclusive MM does expect the rotation will follow this path over the coming weeks/months but most importantly these are moves we are looking to fade if / when bond yields pop on the upside.

Winners: Energy and Healthcare – a mixture of defensive and inflation-orientated stocks.

Losers: Consumer Discretionary, Real Estate and IT – interest rate sensitive and growth-dominated names.

Seasonally the ASX should now chop around for a few months before it refocuses on the bank dividends due in November followed closely by the traditional Christmas rally which feels like it’s approaching way too fast! Ideally, on the index level, we are looking to increase our market exposure into the next 200-point pullback but in today’s rotational-themed market plenty of excellent entry opportunities could arise with the market hovering around current levels.

US stocks edged higher overnight as buyers emerged into any weakness intra-day, a similar characteristic has been witnessed locally over the last few weeks. The trickle of economic news and earnings numbers were mixed and the market struggled to find anything to key off with the S&P500 finally closing up +0.2%, the SPI futures are looking for the ASX200 to open up +0.3% making fresh monthly highs in the process.