The ASX200 again made fresh 10-week highs yesterday helped by strength from the consumer-facing stocks but the buying was broad-based in nature with almost 70% of stocks on the main board advancing. The sector which stood out the most to MM were the retailers with all 8 in the ASX 200 Retailing Sector advancing. While we own discretionary retail stocks across three of Market Matters portfolios, our Flagship Growth portfolio doesn’t which feels like an omission given the better than feared outcomes being achieved – MM has a couple in our Hitlist but we’re exercising a little patience, at least for now.

The last 2-months have seen the stock market regain its mojo with 2 very important factors being accredited for its change in fortune, a belief that peak inflation could already be in the rear-view mirror and a reporting season that’s showing corporate Australia is largely in good shape. Ironically there’s a dichotomy between these 2 fundamental factors:

- Peak inflation implies bond yields/interest rates should stop rising sooner rather than later but they’re actually threatening to make fresh highs into Christmas.

- One of the reasons local companies are reporting strongly has been their ability to pass on price increases to customers but this by definition is stoking the inflation fire.

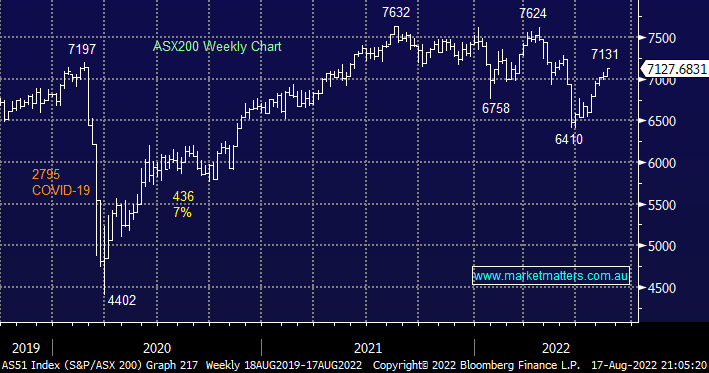

MM still believes stocks rallied predominantly because investors, retail and professional alike, simply found themselves way too short/underweight the market hence when they started to buy there was a total dearth of sellers propelling the market higher & faster than most including ourselves thought likely – we were bullish in June looking for a rally towards 6900, and potentially 7000 area. It’s important to note as we said yesterday when we looked at the Bank of America Fund Managers Survey – “Investors are no longer apocalyptically bearish stocks with 88% of Fund Managers (FMS) surveyed now expecting lower inflation in the next 12 months while exposure to cash was reduced to 5.7%, but it still remains well above the long-term average of 4.8%”.

The markets are probably ready for a sharp decline because we’re now adopting a slightly more bullish stance towards the ASX200, we are still looking for some consolidation in the 6900-7150 region but the level where we intend to start increasing our risk/market exposure has clearly risen over recent weeks with the market still adopting a fairly light exposure to stocks.

US stocks experienced a choppy session last night with tech stocks falling -1.2% even with Apple Inc (AAPL US) edging higher after announcing the iPhone 14 will launch in early September, higher than expected UK inflation weighed on growth stocks as it sent bond yields higher across the curve. The SPI Futures are pointing to a small -0.2% drop early this morning, outperforming the S&P500 which fell -07% and the European Euro Stoxx which fell -1.3%.