The ASX200 roared higher on Thursday on optimism that peak inflation is behind us but not all parts of this fascinating puzzle are currently in alignment:

- FX: The $US is slipping while growth / risk on currencies like the “Aussie” are rallying suggesting that “peak inflation” may already be in the rearview mirror.

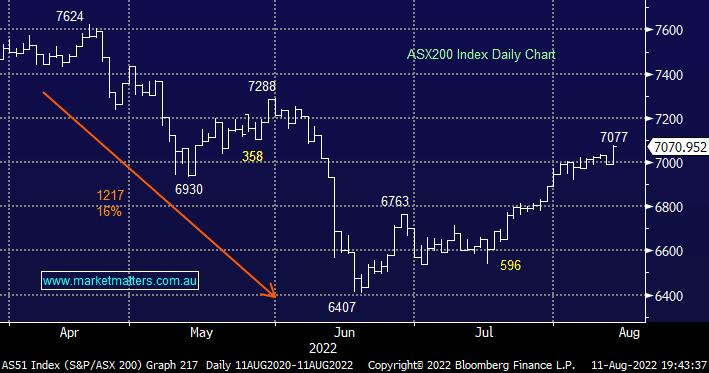

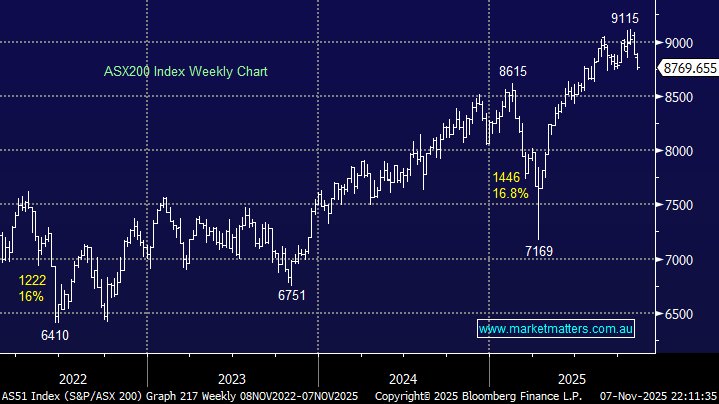

- Stocks: Global equities have been rallying since mid-June on declining bond yields, the local market posted fresh 9-week highs yesterday following this week’s moderate US CPI print.

- Commodities: Most fell hard from their March highs on recession fears and the current bounce is fairly mooted to date i.e. no great read-through here.

- Bonds: Yields have been correcting since mid-June but they’ve actually rallied over the last fortnight ignoring this week’s more benign inflation print in the process.

At this stage MM is sticking to our neutral stance towards equities, we’re not convinced that yields aren’t steadying themselves for a rally to fresh 2022 highs, or in other words, bonds are telling us that its way too early to believe that the inflation gene is back in its lamp. Ongoing strength in yields last night pushed the main Tech Index down -0.65% illustrating how this could play out. There are a few statistics to keep very much in the front of our minds when we consider stocks and deciding when peak inflation will or has topped out:

- If we have already passed peak inflation history tells us the ASX will rally on average 13% over the next 12 months – we’re not positioned quite bullish enough for this just yet.

- Also equities usually bottom 3-months after peak inflation which suggests to us that either way another leg lower is a strong possibility for stocks i.e. no reason to panic on the buy side just yet.

Overall the important message here is while we believe equities will have one more dip lower MM will not hesitate to buy stocks at higher levels if we believe the QT cycle is already done and dusted – either way, our next overall action will be to increase market risk & exposure.

Last night was a mixed session on Wall Street which erased early strong gains as bond yields continued to rise, growth stocks slipped while most value pockets rallied resulting in the S&P500 closing down just -0.1%. The SPI Futures are calling the ASX200 to open down ~0.25% this Friday morning.