The ASX200 struggled on Wednesday with many traders taking a back seat ahead of last night’s important US CPI (inflation) data, the index ultimately closed down -0.5% basically at the same level we started August. Selling was broad-based with 70% of the main index closing in the red but with the influential Banking Sector closing higher, even as Commonwealth Bank (CBA) slipped -0.3%, losses were limited i.e. for fireworks to be lit under the index we generally need to see the Resources & Banks run in one direction.

- The Banks have recovered very well since their -18% plunge in June with only ANZ Bank (ANZ) down year to-date – CBA is set to pay an attractive $2.10 fully franked dividend next week making it easy to comprehend why most investors remain reticent to sell their stock but again when dramatic market sentiment swings have occurred over the last year the banks have often followed suit e.g. CBA itself fell -18.5% in June alone.

- The Resources have experienced a mixed bag through 2022 with the large-cap miners a touch softer while the energy names have soared with the largest Woodside Energy (WDS) +45%.

For now, the cocktail of rising interest rates and a possible recession has created some volatility in these 2 major sectors but rotation is the dominant theme, conversely, the tech stock got hammered between November’21 and June”22 on rising bond yields before bouncing well as recession fears receded taking yields lower in the process. Basically, it’s important to know what’s driving sectors outside of a company’s individual performance which is determined by its traditional financial metrics and outlook:

- Banks – are comfortable with rising bond yields but not a recession as it suggests higher bad debts, lower lending activity etc.

- Resources – primarily focused on their underlying commodities which are very vulnerable to elevated recession fears.

- Tech – the major concern for this pointy end growth sector is rising bond yields.

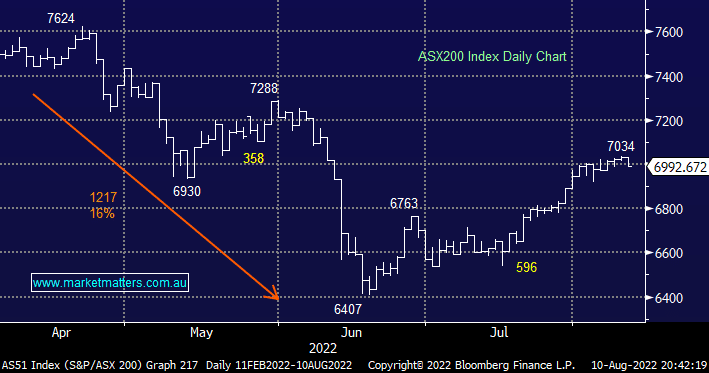

On the index level MM remains neutral Australia short-term with a break of 6700 by the ASX200 required to generate a technical sell signal, our preferred scenario is we get ongoing consolidation around the 7000 region.

After a strong session on Wall Street we are poised to open ~7050 this morning, back at 9-week highs.