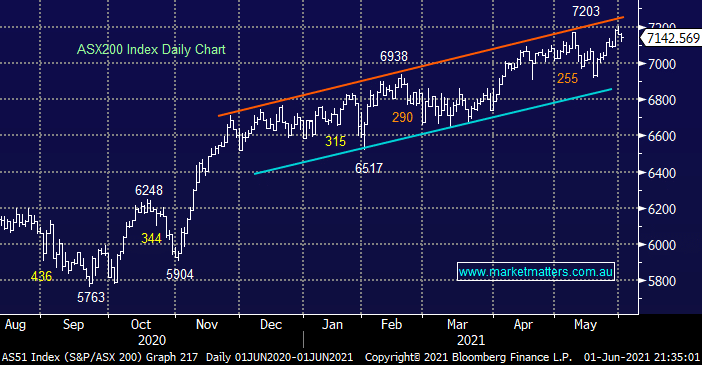

On Monday the ASX200 again enjoyed decent buying surface into early weakness, the index ultimately recovered well over 50% of its mid-morning losses, even though over 60% of stocks still closed down on the day. Overall it was a pretty quiet start to June with only 1% of the main index moving by 5% while on the sector level we saw further rotation with the financials and healthcare stocks drift lower being largely offset by a solid session by the resources, led for a change by the energy complex.

The “buy the dip” mentality continues to prevail which is a touch frustrating for ourselves as we’ve been hoping for a slightly deeper pullback to again migrate our portfolios back up the risk curve. This ongoing characteristic is also being witnessed on both the stock and sector level, basically pockets of the market that have struggled for much of 2021 are starting to regain their mojo whereas some previous high flyers over the last 6-months have been crunched e.g. Costa Group (CGC) –28% and EML Payments (EML) -43%. In other words investors shouldn’t be afraid to take profits in 2021 if / when they present themselves.

On the index level the story remains the same, stocks have been grinding higher for 6-months and while there’s no reason to fight this underlying trend we do believe the stocks /sectors doing the heavy lifting will continue to rotate. MM believes the second half of 2021 will see the performance baton continue to be handed over in a few cases hence expect MM to remain fairly active under the hood across our 5 portfolios.

Overnight we saw US stocks reopen after the Memorial Day holiday, they tried to rally for most of the session only to give back the gains into the close, the tech stocks led the decline with the NASDAQ closing down -0.2%. The SPI futures are calling the ASX to open slightly higher helped by BHP following the rally in oil, it closed up +2.7% in the US well above the $49 area.