The ASX200 managed to rally +0.2% yesterday as strength across the broad market was enough to offset selling in the Resources Sector following the significant declines from the likes of copper and crude oil on Tuesday night. The market actually closed on its highs after reversing early losses as some bargain hunting entered previously weak pockets of the market although investors will need convincing that a recession isn’t imminent before we’re likely to enjoy some meaningful follow-through.

- The market felt a little short and definitely nervous ahead of last night’s US inflation print, Shawn actually said yesterday afternoon “if things aren’t too bad in the morning this market feels ready to pop higher”.

- This morning it looks like he was on the mark – after an initial knee-jerk reaction lower by US stocks, they recovered strongly with the SPI futures calling the ASX200 to open unchanged this morning.

MM made a number of portfolio tweaks yesterday which may have caught some subscribers by surprise but we mustn’t underestimate the major stock/sector swings that we’ve already witnessed in 2022 and if MM is correct there’s plenty of more action likely to unfold under the hood into Christmas i.e. there’s rarely been a better environment for “Active Investors” assuming they can invest with, as opposed to against the rhythm of the market:

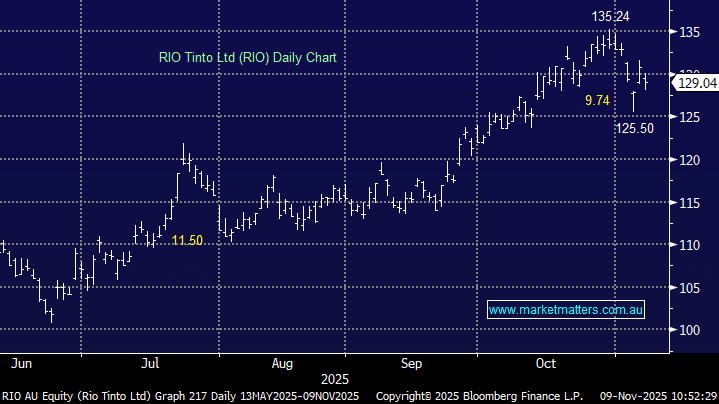

- Over the last month amongst the heavyweight’s BHP Group (BHP) has fallen -20% while CSL Ltd (CSL) has risen +8.3%.

- Similarly over the same timeframe OZ Minerals (OZL) has fallen -31% while ResMed (RMD) has risen +8.2%.

We could have selected more extreme moves but these 2 obvious comparisons illustrate perfectly how tweaking stock/sector weightings can add significant alpha / value to a portfolio assuming of course we get it correct! Remember the average return for the ASX over the last 30 years is just shy of 10% making these intra-month swings very meaningful to the average investor. MM is sticking with our view that the Tech Sector is likely to be the next area to enjoy a meaningful bounce but at this stage, we’re only seeing the occasional glimmer of hope.

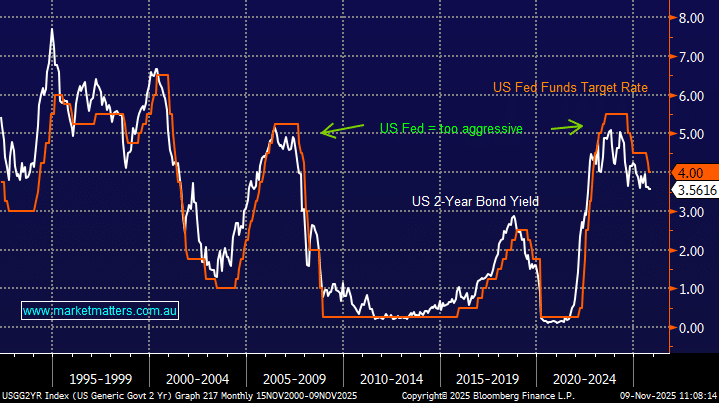

Overnight a stronger than expected US Inflation print sent US stocks plunging lower but we felt their recovery was impressive with the tech based NASDAQ only closing down -0.1% even as hawkish bets increased sending bond yields higher and the Royal Bank of Canada hiked rates a full 1% in its effort to combat their inflationary pressures.

- US inflation rose 9.1% from a year earlier, above the forecasted 8.8%, a 0.75% rate hike by the Fed is now fully priced in for this month with some even looking for the Fed to follow Canada’s lead and go 1%.

- The big question is are we now reaching peak inflation – when the market starts to believe we have “peak inflation” i.e. at the juncture MM expects some aggressive sector reversion both locally and overseas.

We’re clearly not out of the woods yet following this data point but we must always remember that stocks look around 6-months ahead, central banks are undoubtedly fighting hard to contain runaway inflation with the main question remaining can they win the battle without pushing the world into a recession.