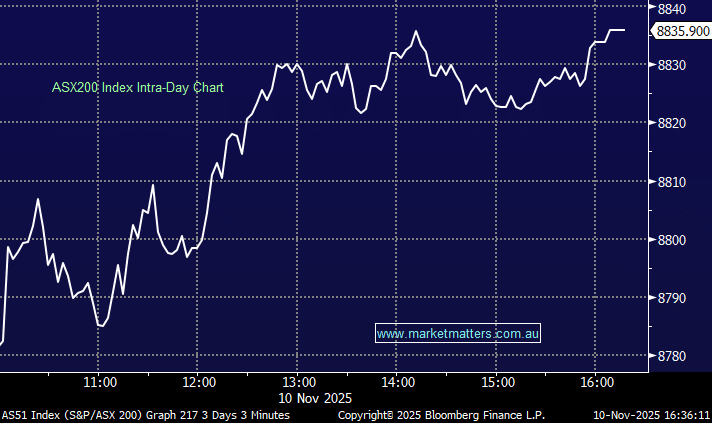

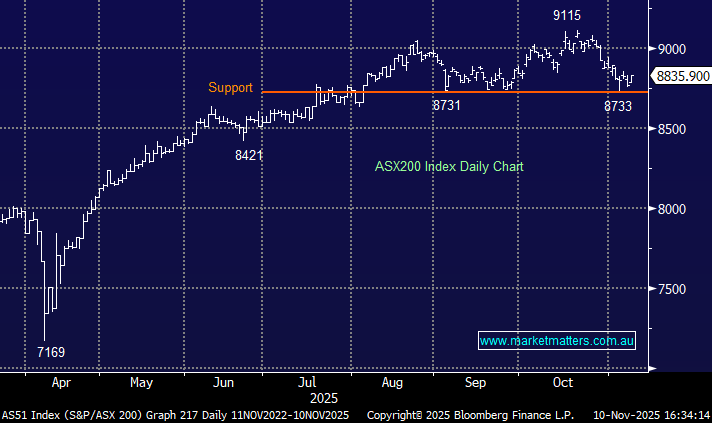

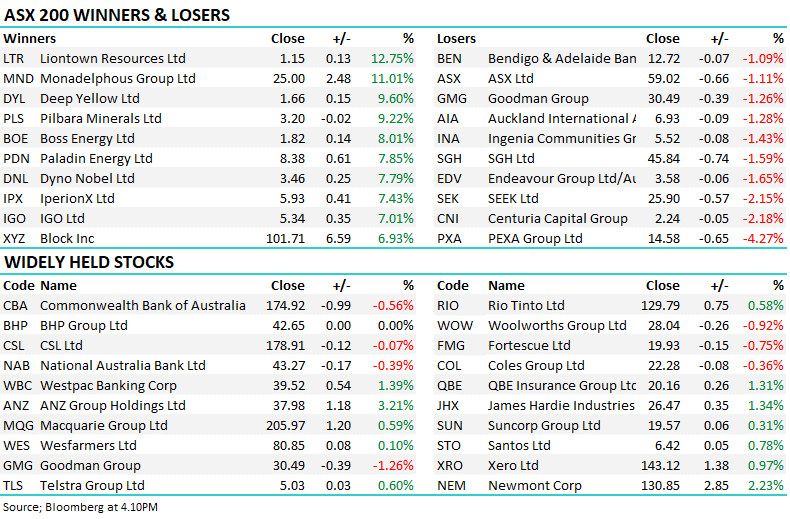

Bizarrely it felt like a positive day for the ASX200 on Wednesday even though the index ended the choppy day down -0.5%, most stocks managed to rally but the weakness for the index came from one very specific and influential sector of the market i.e. the heavyweight resources which were hammered following steep declines across commodities markets on Tuesday night as fears of a global recession continued to escalate. MM has been looking for a snap back in the dislocation between bond yields and tech stocks for a few weeks and it finally kicked into play with a vengeance yesterday supporting the index in the process:

Tech stocks: Megaport (MP1) +14%, Xero Ltd (XRO) +6.7%, HUB24 (HUB) +4.5% and Altium (ALU) +4.1%.

Resources stocks: South32(S32) -8.3%, Iluka (ILU) -7.8%, RIO Tinto (RIO) -7.3%, Newcrest Mining (NCM) -6.6% and Woodside Energy (WDS) -6.9%.

Post COVID we’ve witnessed on a number of occasions trends in stocks/sectors lasting longer and travelling much further than most people thought possible, specifically over the last 6-9 months as we’ve witnessed a seismic shift from QE to QT with interest rates rising at their faster rate in many decades creating some massive disconnects under the hood of the ASX200 e.g. even after yesterday’s moves Woodside Energy (WDS) is still up +37.7% for 2022 while Xero has fallen -39.2%.

- Since last November markets have shunned high-value growth stocks as bond yields soared but these have now started to correct as the risks of a recession rapidly becomes the market’s main concern.

- Commodity prices soared over the last year on the combination of rising inflation fears & severe supply issues following Russia’s invasion of Ukraine, but again these advances are now being reversed on fears that a global recession is slowly becoming inevitable.

MM now believes the long awaited snap back towards high value growth stocks has commenced, they simply took a while to believe that yields could stop rising! At this stage MM isn’t in a hurry to reduce our tech exposure believing they can rally hard and fast over the coming weeks:

- MM expects to tweak portfolios from growth back towards value stocks through the latter part of July & into August but we anticipate some major relative performance catch-up beforehand.

Overnight US stocks rose for their 3rd consecutive session as economic data hinted that growth could be slowing helping the tech stocks outperform rallying another +0.6% while the broad-based S&P500 put on +0.4%. On the sector level energy stocks again fell as crude oil slipped another ~2% but that was offset by 9 of the 11 market sectors rallying. The SPI Futures are pointing to the ASX200 opening up +0.6% this morning offsetting yesterday’s losses in the process.