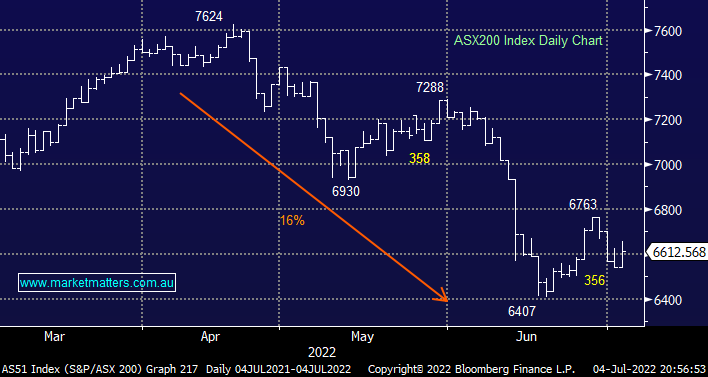

The ASX200 started its first full week of July on the front foot rallying +1.1% on broad-based buying which saw over 80% of the main board close up on the day. All sectors rallied with only the industrials and utilities advancing less than 0.5%, the underlying strength flowed through from the bond market which has started to question how fast central banks will hike rates as recession fears increase, global economic data is already starting to deteriorate threatening a recession sooner rather than later. On balance, MM believes we will see rate cuts in late 2023 but in today’s uncertain markets we must remain open-minded e.g. another scenario is central banks ease off through 2022 to avoid a recession only to let the inflation gene run amok leading to significantly higher rates in time.

There was a definite “risk-on” feeling in the air yesterday albeit understandably muted with the RBA looming at 2.30 pm this afternoon – overall once this hike is out of the way assuming the ensuing rhetoric is reasonable we feel the ASX is poised for a quick rally towards the 6800 area, and probably even higher.

- The RBA is expected to raise interest rates by 0.5% at 2.30 pm this afternoon, taking them to 1.35%, significantly above the 0.1% we enjoyed through all of 2021.

- Whether the hike is slightly more, or less, we expect rates to peak out in 2023 between 2.5% & 3% depending on how quickly inflation and the local economy get reined in.

Time will tell how capable the RBA are of juggling a reduction of inflation while normalising interest rates and avoiding a painful recession all at the same time, when we consider how late they have been to the “rate-hiking party” we believe they will need a touch of luck to enjoy a happy consumer in 2023. However, as investors, we believe the inevitable swings in sentiment as the market attempts to 2nd guess where the economic journey will end is almost inevitably going to deliver some excellent investment opportunities over the next 6-12 months.

US stocks were closed overnight as 4th of July celebrations kicked into gear for Independence Day giving the stock market a long weekend. The SPI Futures are flagging a quiet open as we wait for the decision from Philip Lowe et al.