The ASX200 put in an average performance yesterday after a promising start as it attempted to recoup some of Tuesday’s plunge following the RBAs aggressive rate hike, we finally closed up 25-points after the index surrendered over half of its early gains as the banks took one of their biggest hits in a long time e.g. Westpac (WBC) -6.1% and Commonwealth Bank (CBA) -4.4%. MM had highlighted earlier in the month that the banks usually struggle through June but even we were surprised by the severity of their decline – we cited this seasonal weakness looming on the horizon as a headwind for the ASX over the coming weeks and its already causing issues as investors become increasingly worried about the ramifications of rising interest rates – nothings particularly changed over recent weeks except the markets focus especially following UBS’s cautious report yesterday morning:

- The “Big 4 Banks” are largely unchanged for 2022 after paying healthy dividends while over 30% of the ASX200 are down by more than 20% making it easy to comprehend why some investors are pressing the switch button.

- There has been nothing subtle about the stock/sector rotation within the ASX over the last 6-months which is one of the reasons MM is cautious on the Banking Sector during the coming weeks.

- Also if MM is correct and bond yields are at least due for a rest some migration from value to growth names is to be expected although the tech socks still appear largely friendless – a relatively minor influence at this moment in time.

Elsewhere we have to again mention the Energy Sector which saw the likes of Woodside Energy (WDS) and Santos (STO) make fresh post-COVID highs, we remain long and bullish on the former but it is slowly edging towards our target, another ~5% and we may consider taking profit – we saw yesterday with the banks that all good things don’t last forever in today’s volatile and fickle market, especially on the sector level.

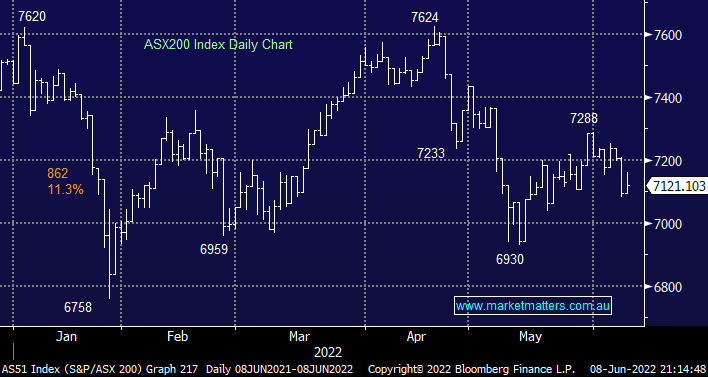

It’s amazing how the ASX200 index continues to trade sideways yet day to day it feels like we’re riding a giant rollercoaster. Technically a close back above 7200 will look good and under 7100 a concern but really the common denominator is the random nature of the Australian index over the last 12-months however if the banks are set to struggle into the EOFY it’s likely the ASX will underperform its global peers.

Overnight US stocks struggled with the S&P500 slipping -by 1.1% as oil surged above $US120/barrel after inventories/stockpiles dropped intensifying fears around rising inflation while not surprisingly the Energy Sector was the only group that managed to close up on the day. US Treasury yields edged above 3% as oil advanced but there was no aggressive momentum behind the move. The SPI Futures are calling the ASX200 to open down 50-points this morning erasing yesterday’s gain in the process.