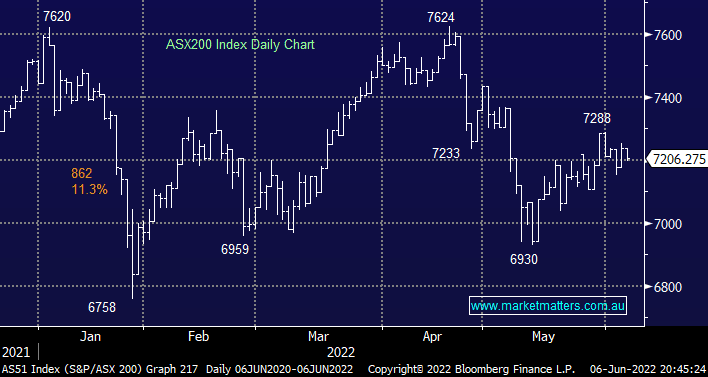

The ASX200 commenced the week on the back foot falling -0.45%, erasing the month of Junes small gain in the process, the selling was light but fairly broad-based with less than 20% of the main board managing to rally on Monday. With both the US & UK after-market Futures rallying strongly throughout the day AEST it felt like the local market was being held hostage by the RBA’s interest rate decision at 2.30 pm today – there are mixed opinions as to how far Philip Lowe will go with the interest rate markets pricing in a 0.28% rate hike and for the cash rate to reach 2.9% by the end of 2022. Markets hate uncertainty hence if overseas markets remain well supported and the RBA doesn’t go any further than a 0.4% hike to 0.75% MM is comfortable with its short-term bullish forecast.

- We wouldn’t be surprised if the RBA hiked by 0.25%, 0.40% or even the aggressive 0.50% anticipated by Goldmans but it will arguably be the accompanying comments that dictate how the market reacts to this almost inevitable rise.

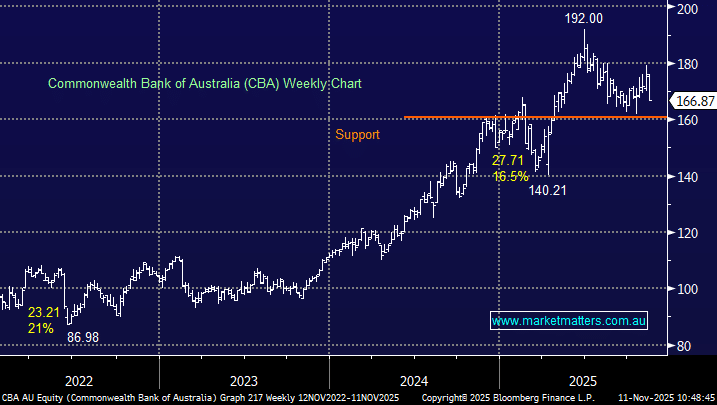

Historically the banks struggle between May and June and they usually don’t fully regain their “Mojo” until October, a period of underperformance feels like it’s already starting to slowly play out which will make it extremely hard for the ASX200 to make a meaningful assault on new highs anytime soon. On the fundamental level it’s easy to understand why this influential part of our market may take a rest in to the EOFY:

- The “Big 4 Banks” have all traded ex-dividend in 2022 with no more appetising payouts due for shareholders until mid-August for CBA and November for the remaining 3.

- Appreciating bond yields has provided a solid tailwind for the banks over the last 6-months, if we are correct and it’s time for them to at least take a breather MM can see some profit-taking roll through the sector.

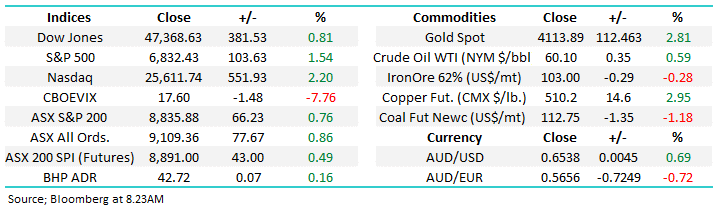

Overnight US stocks rallied strongly before falling away after midnight with the S&P500 finally closing up just +0.3%, a number of bond yields edging above 3% kept the advance in check. Amazon.com led gains in the tech space following a 20-1 stock split which helped the embattled sector outperform ending the day up +0.4%. Europe and the UK was the standout region helped by Boris Johnson surviving a no-confidence vote, most major indices rallied +1% or more i.e. usually a great read through for the ASX200.

- Bitcoin caught our attention on the upside for a change with the crypto surging ~5% suggesting risk assets are finding support after their tough 6-months.