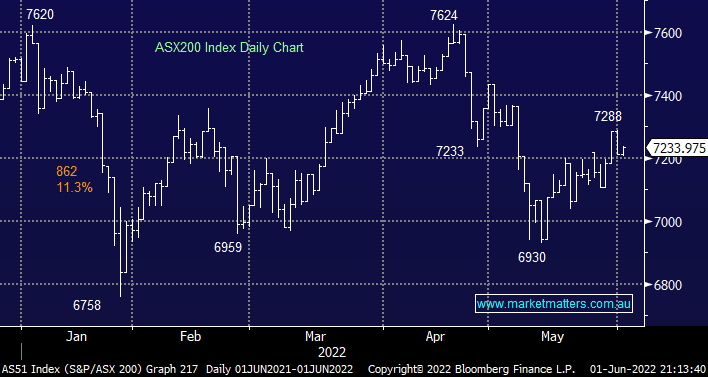

The ASX200 experienced a choppy Wednesday but some healthy buying into the close finally saw the index enjoy a gain of +0.3%. Stock & sector rotation was yet again the main game in town with 10% of the main board falling by over -5% while 7 names were hammered by more than -10%, however the influential banks recovered some of their recent losses which when combined with advances by the major iron ore producers was enough to take the index higher even with less than 40% of stocks rallying. This time the underlying theme was clearly “risk-off” with a couple of specific sectors receiving close attention from the sellers:

Winners: Telcos, iron ore stocks and banks.

Losers: Battery metals, gold stocks, tech and healthcare.

It would be easy to say yesterday was just another day of rotation between “risk-on” and “risk-off”, which of course the latter has been the winner so far in 2022, but it’s the first time for a while that we’ve seen ESG battery metals stocks smashed e.g. Pilbara Metals (PLS) -22%, Allkem Ltd (AKE) -15.4% and IGO Ltd (IGO) -11.7%. MM will be taking a closer look at whether we agree with Goldman Sachs that it’s the end of the road for the battery metals names for the foreseeable future in a morning report in the not too distant future.

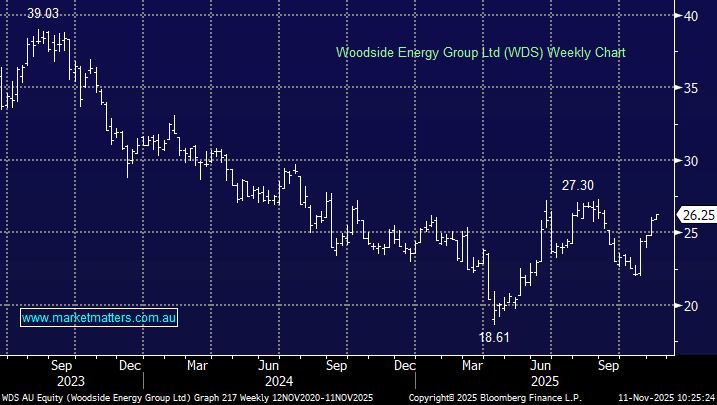

Overnight JP Morgan was looking to place the remaining Woodside Energy (WDS) stock from the company’s scrip purchase of BHP Petroleum, fund managers took the opportunity to buy the stock at $29.15, below its last traded price of $30.19. It might initially concern some investors that 38 million shares are about to hit the market at a discount of up to 3.4% below yesterday’s close but we believe it could be a bullish catalyst for the stock:

- The WDS stock was mostly sold by BHP’s South African shareholders who weren’t eligible to take up the offer i.e. it’s not “fresh news” and the overhang has quickly been removed from the market.

- As MM has discussed previously, WDS has underperformed recently due to the nuts and bolts of the BHP deal including this overhang e.g. over the last month Santos (STO) is up +2.5% while Woodside Energy (WDS) has slipped -3.1%.

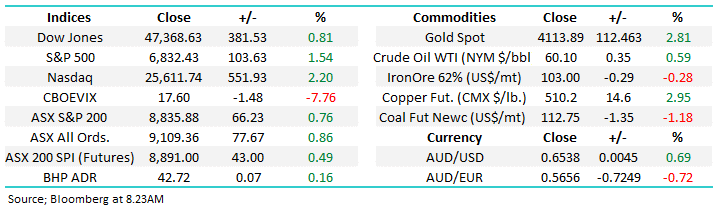

Overnight US stocks fell away sharply after strong economic data at midnight (AEST) intensified concerns around the degree of interest rate hikes through 2022 / 23, the strong US Manufacturing & Job Opening numbers showed the Feds hikes haven’t yet reined in growth and hence inflation as investors skip between concerns around rate hikes and a potential recession with interest rates clearly front and center today. The S&P500 closed down -0.75% with financial stocks leading the decline, the SPI Futures are calling the ASX200 down over 50-points early this morning with energy stocks likely to be the best performers.