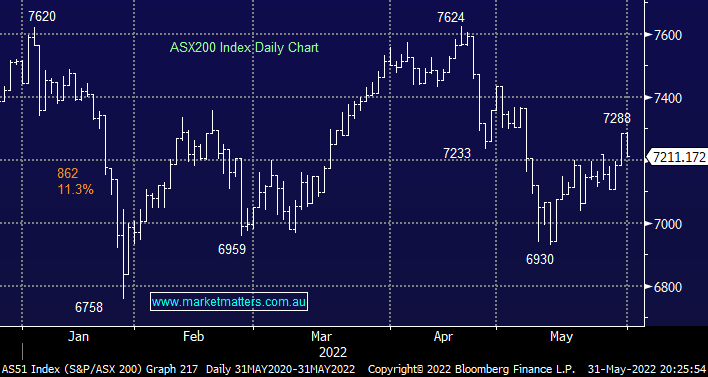

The ASX200 was sold off over 1% yesterday in classic “two steps forward – one step back” fashion i.e. after basically rallying from 7100 to 7300 in just 2-days we’re back at 7200, the middle of the last 12-months trading range. The banks weighed on the index on Tuesday with the “Big Four” falling an average of 2% while the Tech Sector was back under pressure falling -1.9% however losses were fairly broad-based with 65% of the main board declining as “risk off” seems to follow “risk on” as fast as night follows day!

A couple of standouts caught our attention on the sector level during yesterday’s weak session:

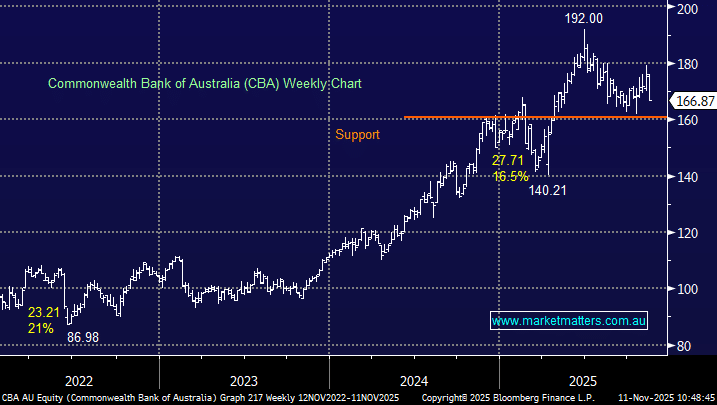

- The Australian Banking Sector is starting to struggle even on days such as on Tuesday when bonds yields rise – not a great sign short-term.

- We flagged the Insurance Sector to struggle yesterday assuming the market felt yields had topped, coincidentally the group were whacked yesterday for a couple of reasons.

- Tech stocks remain in the firing line on “risk-off days” especially when yields bounce i.e. investors need no excuse to sell growth names.

As we’ve mentioned previously as we wave goodbye to May seasonally June is a choppy month which historically is best bought in the last few days in anticipation of a strong run into Christmas. While statistics regularly disappoint their disciples the current market is certainly dancing to the seasonal beat in 2022 hence if we do find ourselves testing under 6900 in 3-4 weeks’ time MM will consider moving up the risk curve but for now, the markets continue to deliver copious amounts of choppy unpredictable swings.

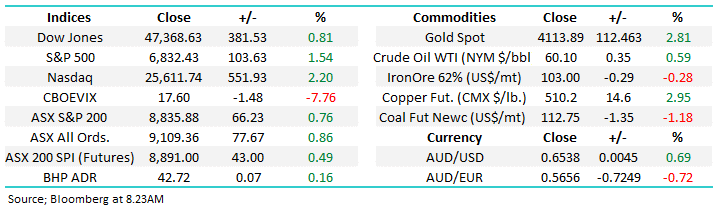

Overnight US stocks surrendered some of their recent gains following the Memorial Day long weekend with the S&P500 closing down -0.4% which surprisingly still delivered a positive if not extremely volatile return for May. US 10-year yields edged up to 2.85% effectively where they started the month while oil was basically unchanged leaving it up +10% for May. This month’s certainly lived up to its reputation on the volatility front with the S&P500 falling over 3% on three days while it ended its longest losing streak in over 20-years with a dramatic +9.4% rally in the last week, all this to end marginally higher!

The SPI Futures are calling the ASX200 to slip -0.4% early this morning.