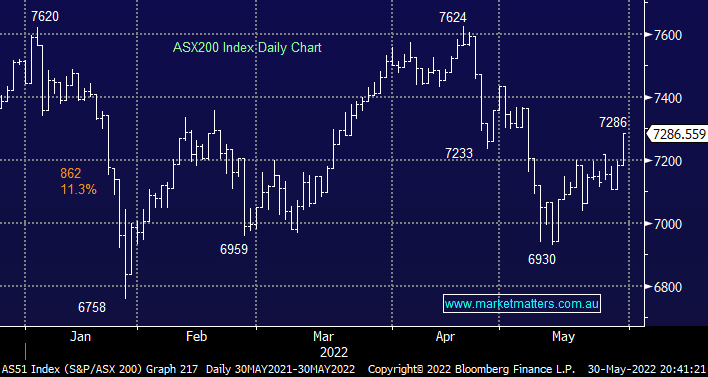

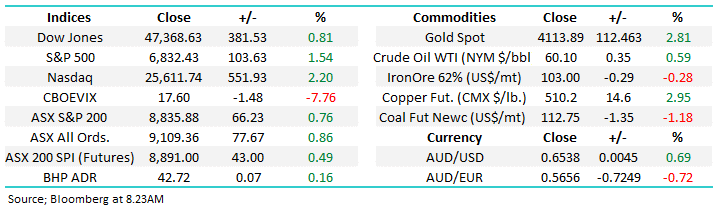

The ASX200 rallied strongly on Monday delivering an emphatic “risk on” session which saw 85% of stocks advance while only the Utilities Sector closed down on the day, the message from investors was loud and clear – “Goodbye & good riddance to April + May!” As we we’ve discussed through recent reports bond yields feel like they’ve topped out for now hence under the hood sector rotation is underway as portfolios which are largely positioned for surging inflation have their hawkish skew at least tempered. We believe yesterday’s relative performance moves across the market groups / sectors will largely follow through, at least short-term:

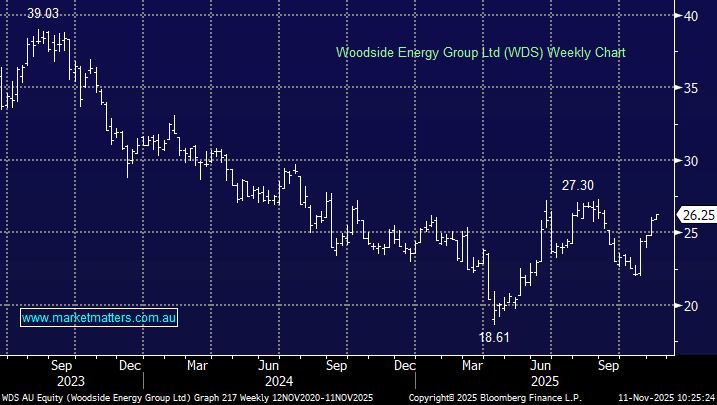

Winners : Tech, Consumer Discretionary, Healthcare, Real Estate and Resources.

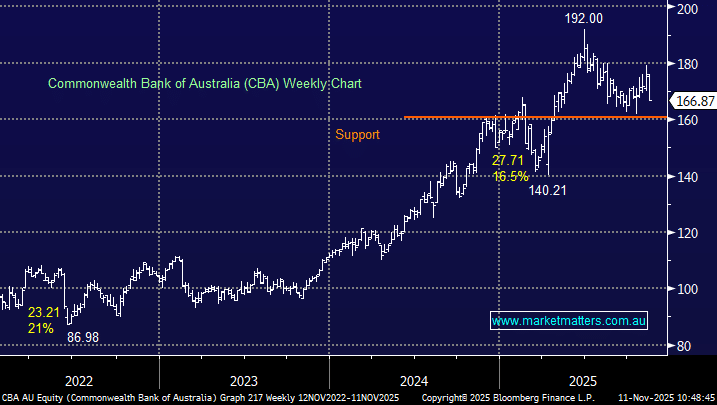

Losers : Banks, Energy, Insurance and Utilities.

NB There are in terms of relative performance as opposed to actual moves.

Not all of the sectors mentioned above are influenced by bond yields but MM is also anticipating some reversion on the net performance front over the last 6-months because if fund managers do / have change their minds on the course of interest rates by definition a number of the battered names are oversold or cheap and they are likely to fund some of these purchases with simple profit taking.

News broke at around 9pm last night that Labor had finally secured a majority following many days of counting across 3 extremely close seats, great news in our opinion that whoever is in power doesn’t need to dance to a minorities tune, good luck PM Albanese. One area that many people are hopping the new government can improve is Australia’s recently troublesome trading relationship with China, ironically yesterday we saw the impact that overseas trade can have on our companies when Bubs Australia (BUB) signed a deal with the US government for 1.25 million tins of infant formula which sent the stock soaring +40% and peer a2 Milk (A2M) up +11%.

Overnight US stocks were closed for Memorial Day but their futures were firm up +0.5% while a solid performance from US bourses looks set to help the ASX200 hold onto yesterday’s gains, at least early this morning.