The ASX200 experienced a tough Thursday falling -0.7% as the previous sessions selling in the futures morphed into a 2-day affair, ironically under the hood it was a clear “risk on” session as we saw weakness in the leading supermarkets while the Tech Sector rallied over 1%. Unfortunately it now appears that the semblance of strength in our growth stocks will need another catalyst after Canadian suitor Telus pulled its $1.2bn bid after just a few hours, were used to takeover bids failing but this is getting crazy, only a few weeks ago a similar thing happened with CVC’s bid for Brambles (BXB). Interestingly we saw 6.4mn shares change hands yesterday under the premise of a $9.50 takeover bid, we would be livid if MM had been amongst the buyers.

- I would be a very frustrated shareholder if I saw the APX board fail to bend over backwards and welcome a suitor who was offering a 50% premium to its last trade, we may never know exactly what made Telus walk but we imagine the stock will fall sharply this morning.

Labor now looks set to win their first outright majority since Paul Keatings victory almost 30-years ago and Prime Minister Albanese has already been busy representing the country in Japan. As we’ve said before MM is neutral when it comes to politics but we are now keen to see an outright majority as opposed to the government being held to ransom when they try and implement their policies i.e. the people have voted them in let’s give them a fair go!

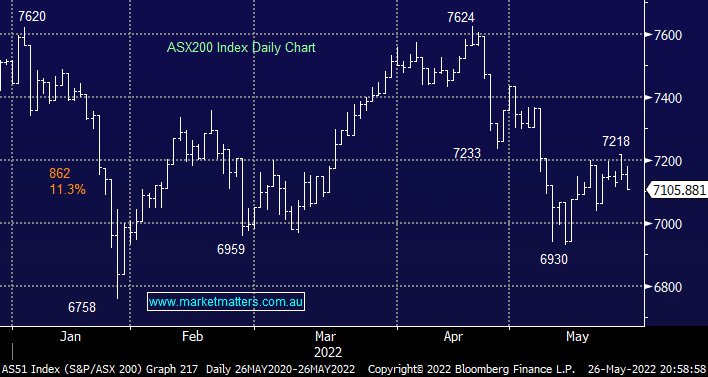

Internationally we are witnessing some wild swings by US stocks and in particular the Tech Sector but locally things have gone extremely quiet, the index is basically unchanged over the last fortnight and as we’ve said before 2nd guessing what comes next is proving a frustrating waste of time. On the index front we still have the same 2 levels “controlling” whether we would be buyers / sellers from a simple risk / reward perspective:

- MM likes the ASX200 under 6800 and on a close above 7250, around 7100 we are by definition neutral.

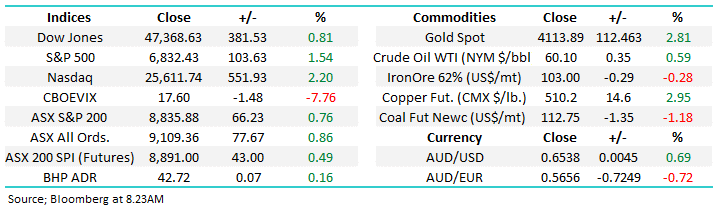

Overnight we saw US stocks roar higher after investors started to reset their overly hawkish views towards interest rates plus a couple of discount retailers beat on the earnings front sending the Consumer Discretionary Sector sharply higher followed nicely by the influential tech names, hopefully the local stocks can take solace from this move to overcome the disappointment around Appen (APX). The SPI Futures are calling the ASX200 to open ~1% higher this morning, back around the highs of yesterday morning.