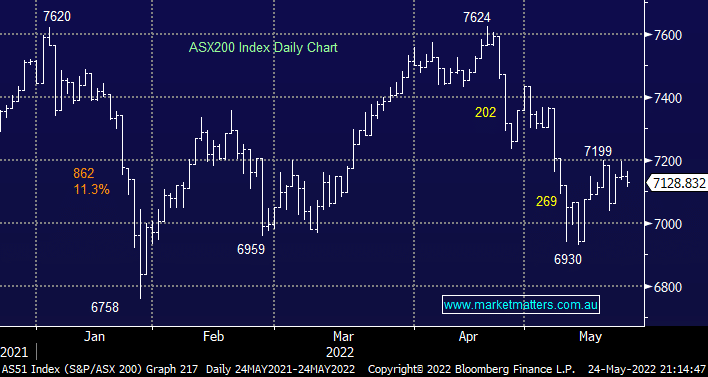

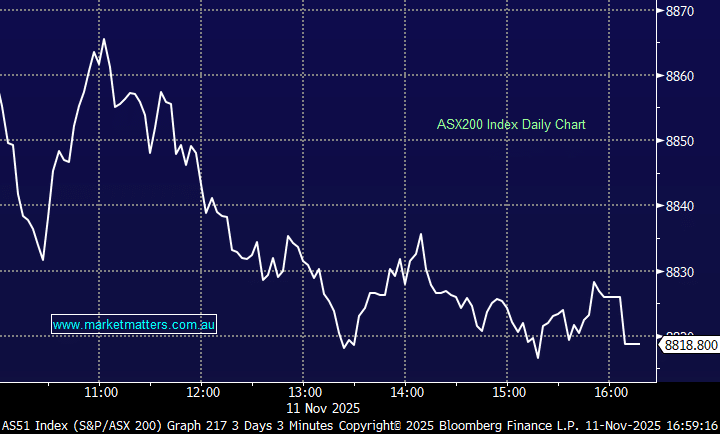

The ASX200 drifted lower yesterday afternoon largely in sympathy with weak US futures and regional equity markets but overall it was another fairly lacklustre day considering yet another gaffe by Joe Biden towards Taiwan and the severe downgrade by Snapchat (SNAP US) which saw the stock plunge over 30% in late US trade. The local market hasn’t moved in over 12-months hence it makes little sense getting too bearish / bullish around current levels but we still think stocks are starting to absorb bad news in a more constructive fashion and the markets internals are improving, let’s hope were not looking at things through rose coloured glasses!

Equities have danced to the bond yield tune since late 2021 but as rates look to have entered a period of consolidation it appears we’ll need a fresh catalyst to move stocks in a meaningful manner in either direction. Assuming we don’t see another left field macro shock MM feels the entrenched negativity and high cash levels could create a short squeeze although the index does feel as comfortable around current levels as my dog in front of the fire!

We found it very encouraging yesterday to read that new Prime Minister Anthony Albanese is already on the front foot towards repairing relations with China, one particular area where MM was critical of ScoMo’s lose / lose approach i.e. you don’t play chicken with Xi Jinping when you only have some iron ore exports in your corner. Prior to the Quad meeting in Japan China had already made positive noises towards Saturdays election result implying the change in leadership could be used to reset the toxic bilateral relationship. When Chinas making positive overtures “the Chinese side is willing to work with the Australian side to review the past, face the future, uphold the principles of mutual respect, mutual benefit and win-win results” things certainly feel on track to improve from recent years.

- Anthony Albanese already looks poised to significantly improve trade relations with China which should only be good news for the local economy and a number of companies hoping for fair and equitable trading opportunities with the super power.

Overnight US stocks were a very mixed bag with Snap Inc (SNAP US) plunging ~40% weighing heavily on tech sentiment resulting in the NASDAQ Index falling -2.2% whereas the Dow rallied +0.2%. The SPI Futures are calling the ASX200 to open up around 10-points helped by a +1.5% gain by BHP Group (BHP) in the US, the BHP – Woodside demerger will be closely watched by many investors over the next few days.