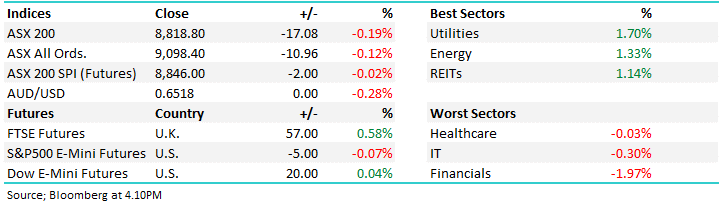

The ASX200 closed mildly higher yesterday with the election already taking a backseat to global economic news, on Monday it was stocks embracing the news into the weekend that China plans to reinvigorate its economic growth with over $US5 Trillion of stimulus after the “COVID Zero” policy has sent many industries into a lengthy slumber. The world’s 2nd largest economy is now looking to shift to a productivity-led economy from an investment led growth model that has underpinned the country for around 30-years – more on this later.

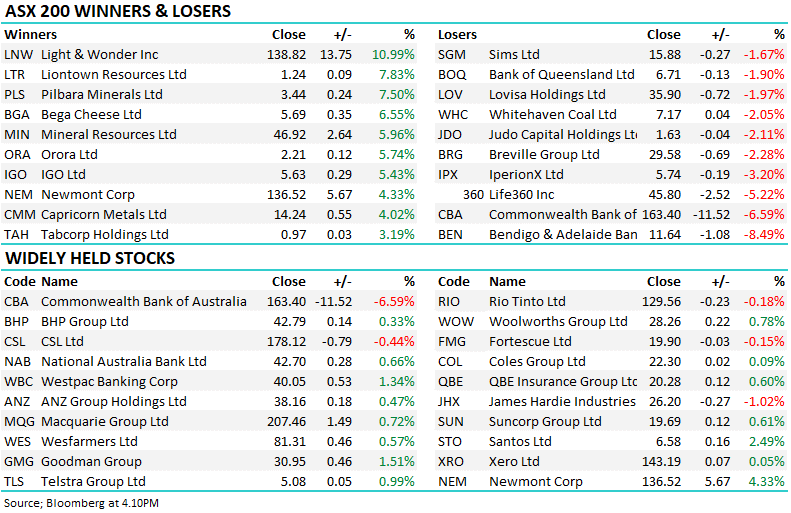

Most of the financial commentary on Monday was around the huge Chinese stimulus but the IT Sector also performed strongly with 79% of the major names rallying over the day. We feel like many of these names are like a tightly coiled spring looking to snap back into the face of extreme pessimism, all that’s missing is a catalyst and of course a little belief:

- The Australian IT Sector has corrected 43% from its 2021 high, we are currently looking for a further +20% bounce from current levels.

- The ASX’s major growth sector has even underperformed the US NASDAQ which has only corrected -31% let alone the ASX200 itself which is still only -6.3% below its all-time high.

- This month’s Bank of America Fund Manager Survey showed cash holdings are at their highest level in 20-years while the Tech Sector remains very much out of favour i.e. whose left to sell?

- Australian and global bond yields have remained quiet for the last 3-weeks not a significant period of consolidation but still a help for growth stocks after the seismic move by yields over the last 6-months – an evolving catalyst perhaps.

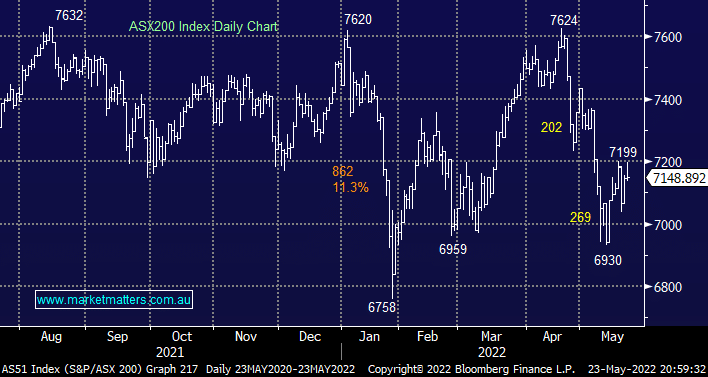

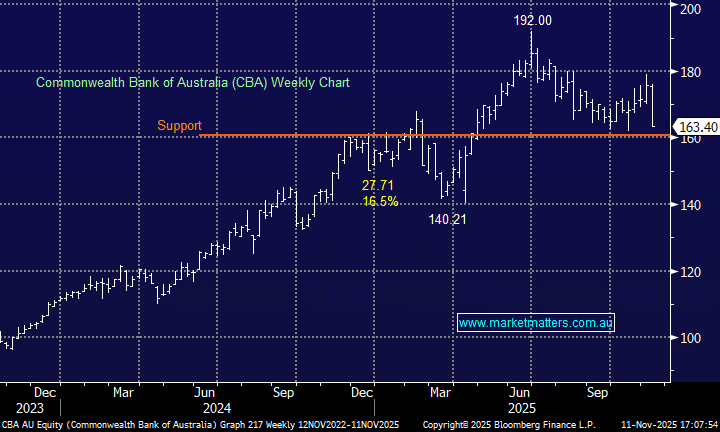

The ASX200 index remains firmly range bound between 6750 and 7650 but a close back above 7250 would swing us to a more neutral / bullish stance from today’s “on the fence” neutral view – a bit micro for most investors but worth noting in our opinion for the very active trader. Stock / sector rotation has dominated the local market for over 12-months but as bond yields appear to have run their race, at least short -term, we are looking for some reversion into EOFY e.g. tech could outperform the “Big Four” banks over the coming months although we like both sectors.

Overnight US stocks enjoyed a solid start to the week with the S&P500 closing up +1.9%, the broad based gains were led by the Financials +3.2%, Energy +2.7% and Tech +2.4% Sectors. The SPI Futures are calling the ASX200 to open up only +0.3% which feels a touch light with BHP Group (BHP) looking set to open around $48.40, up well over 1%.