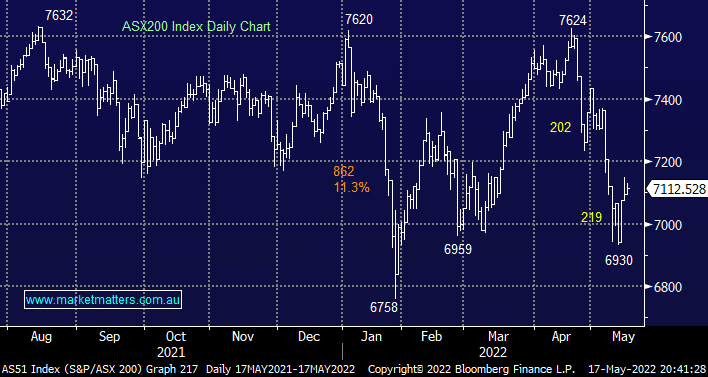

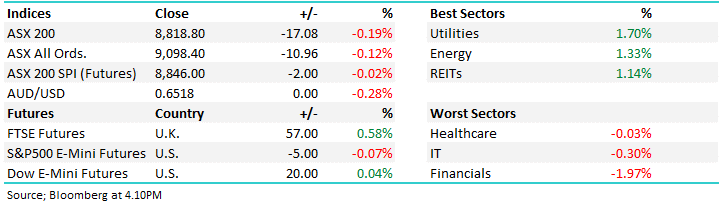

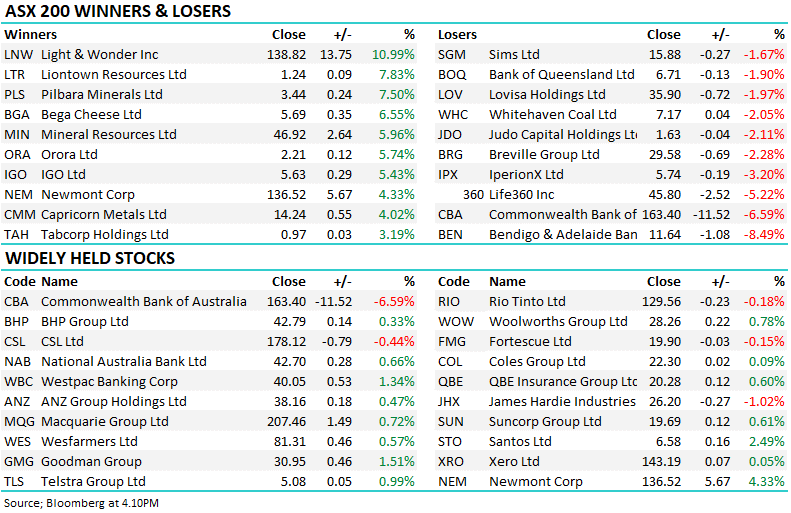

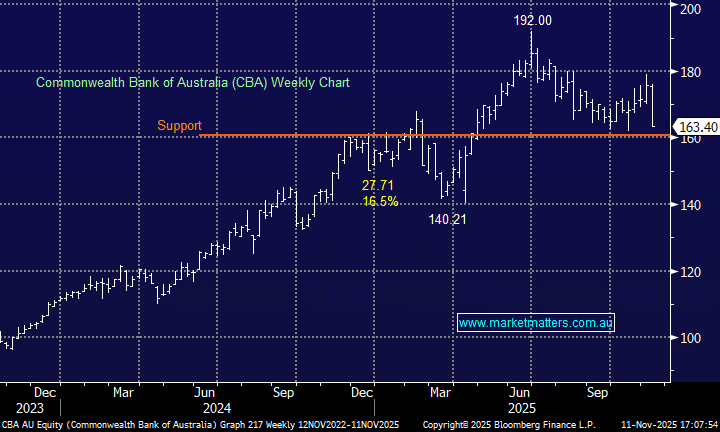

The ASX200 managed to close above the psychological 7100 level yesterday courtesy of strong performances by the banking and resources stocks i.e. the value stocks continue to outperform the jittery growth names. Overall we felt it was a solid performance from a market that’s slowly regaining its mojo after its 9% pullback over the previous 4-weeks, noticeably it shrugged off some hawkish comments from the RBA which would probably have sent the market sharply lower only a few weeks ago:

- The RBA hiked rates from 0.1% to 0.35% early in the month but it could have been far worse as they considered a move to 0.5%.

- Moving forward another increase to 0.75% is almost a definite in June as the RBA struggles to rein in inflation.

Interestingly, as bearish sentiment scales levels not witnessed since the GFC Warren Buffett and Berkshire Hathaway have embarked on a massive buying spree suggesting that according to their metrics value has been restored to a number of stocks and sectors. One thing I haven’t heard in months is “the markets a screaming buy here”, the “buy the dip” sentiment has been echoed at times towards individual tech stocks but not the overall market as investors have succumbed to the deluge of negative news flow over the last month:

- Markets often like to move along the path of most pain and that would be a break to new highs for the ASX200 through 2022, still not too far away.

Our preferred scenario is stocks now enjoy a decent bid tone through to the EOFY which implies stocks that have struggled over recent times will stage comebacks of varying degrees i.e. tech and some commodity stocks have plenty of room to reclaim some of the recent weakness.

Overnight US stocks enjoyed a strong session following apparent hawkish comments by Fed Chair Powell – “no one should doubt the US central bank’s resolve to curb the highest inflation in decades, including pushing rates into restrictive territory if needed”, another example that higher interest rates are becoming old news.

On the economic front US Retail Sales came in stronger than expected while signs from Colgate-Palmolive that supply chain issues are on the mend in our opinion is a very bullish catalyst for at least a strong bounce by stocks. The SPI Futures are calling the ASX200 to open up around +0.9% this morning taking the market back to the mid-point of the last 13-months, far better than it feels.