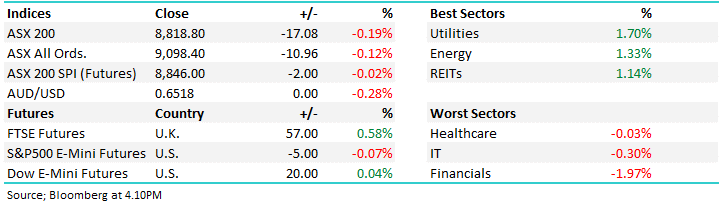

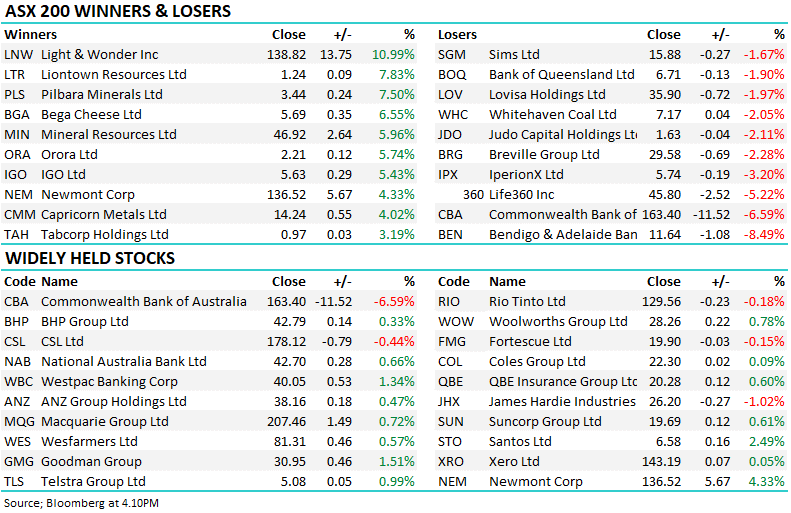

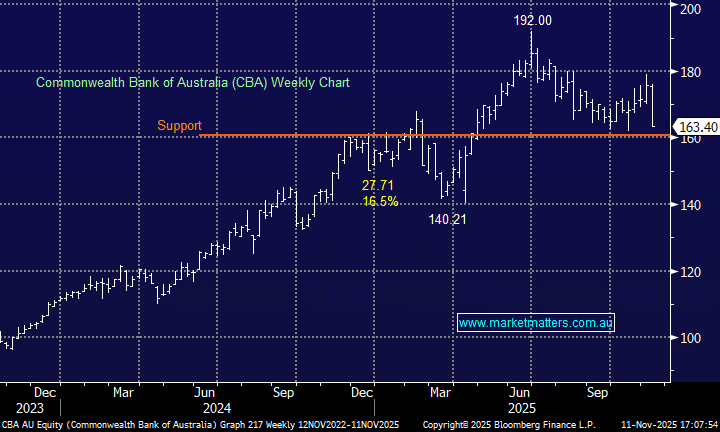

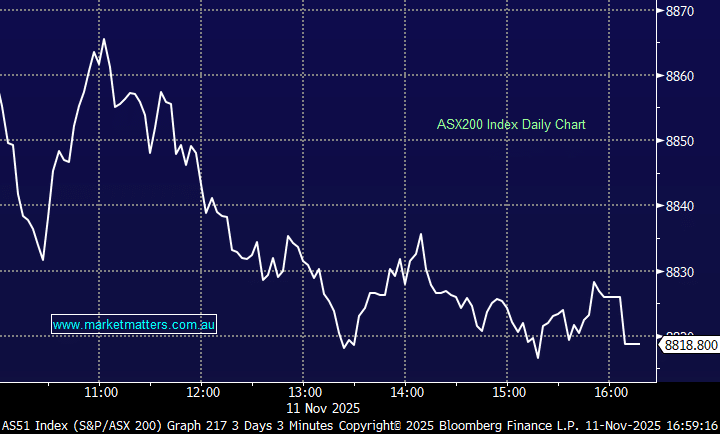

Monday saw the ASX200 surrender most of its early gains as soft Chinese economic data led to weakness both locally and by overnight US futures. As would be expected, when China’s economy appears to be “struggling”, albeit largely self-inflicted due to its COVID lockdowns, our Resources Sector was the main intra-day drag on the index with BHP Group (BHP), OZ Minerals (OZL), RIO Tinto (RIO) and Fortescue Metals (FMG) all falling away to close lower after a strong initial opening.

- China’s Industrial Production year on year fell to -2.9% compared to an estimated +0.5% rise while Retail Sales fell -0.2% for April, this time compared to an anticipated rise of +1.2%.

- Economic activity has collapsed beyond recognition as Xi strives to achieve his zero COVID policy e.g. not one car was sold in Shanghai last month.

However, as the correction to the previously heated Resources Sector gathers momentum we’re starting to question if their decline is maturing just as the bears become more vocal. Yesterday evening saw China initially cut interest rates on home loans by 0.2% to 4.4% and it looks like additional stimulus is highly likely from Beijing as lockdowns bite deeper for longer. We feel the catalysts for a strong upturn are slowly starting to align for China’s growth, just as the data will worry many investors:

- Cities have started to release their plans around phased reopening after prolonged lockdowns although risks obviously remain towards how they will deal with the almost inevitable further outbreaks.

- China has initiated its first-rate cut but unlike the RBA they have plenty of room for further easing and stimulus as they look to put the economy back on track towards some semblance of economic growth.

- The world’s 2nd largest economy looks set to front-load some aggressive stimulus, at least until after President Xi is reinstated for his 3rd term in H2 of 2022.

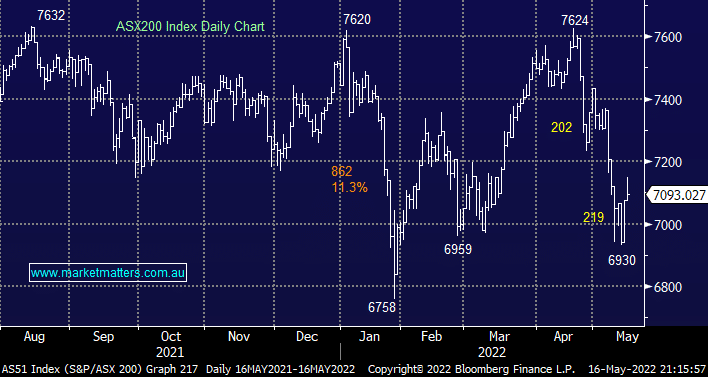

MM has been looking for the ASX200 to fail around 7150, as it did yesterday, before testing under this month’s 6930 low, if we see such a move and its led by weakness across the resources MM is likely to move back into the sector – an idea for subscribers “Hit list”.

Overnight stocks experienced another volatile session which saw the broad market finally close down -0.5% after aggressive selling washed through the mega-caps in the last hour of trade, again on concerns around the abovementioned weakness in China’s economy – US markets are currently pricing in a 40% chance of a recession but if China stays dormant this will increase. The SPI Futures are calling the ASX200 to open up over 20-points this morning, back above 7100 with energy stocks likely to be strong following crude oil’s rise to levels not seen since March.