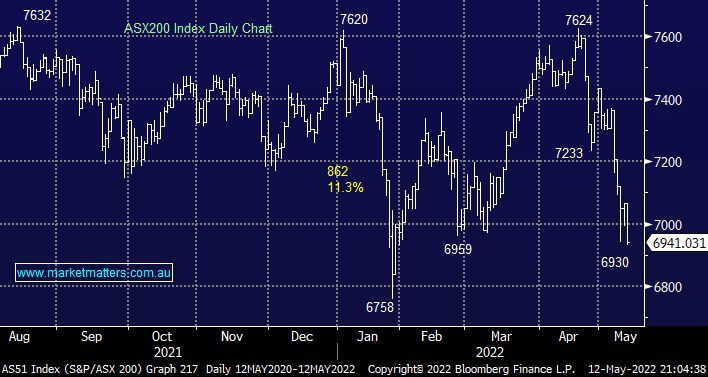

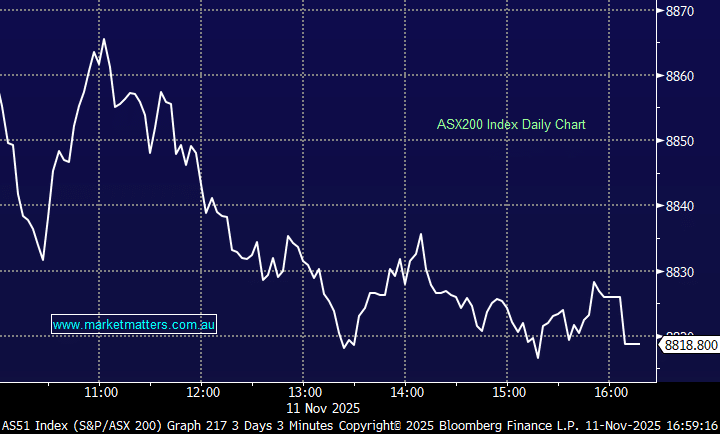

The ASX200 was smacked -1.75% yesterday in a session that both felt and looked awful, aggressive selling hit the futures market as soon as stocks opened and it didn’t take a backward step all day – intraday alone the SPI futures fell 110-points compounding the negative opening courtesy of further weakness on Wall Street. Not surprisingly all 11 sectors fell on Thursday but tech was again the standout dropping -8.7%, a sector move that would usually be associated with a quarter as opposed to one day!

The primary baton of market concern appears to have been passed from inflation & rate hikes to a 2-pronged attack from arguably even bigger forces, US 10-year bond yields are back at mid-April levels but the selling towards the growth names is accelerating from already depressed levels:

- The markets factoring in an increased probability of a recession over the next few years with confidence in central banks diminishing by the day – Goldman Sachs are now pricing the odds of such an outcome at 35%.

- Investors are bracing for liquidity to be sucked from risk assets as QT (quantitative tightening) kicks in after an unprecedented period of huge QE (quantitative easing) – it can’t be good but the problem is nobody knows how bad it will be.

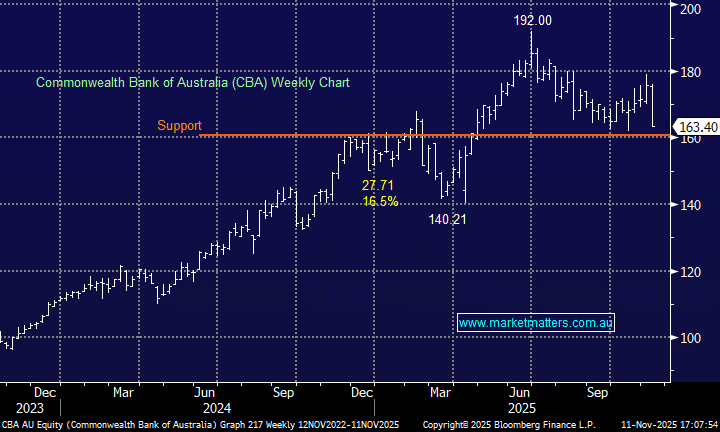

We read an interesting article in the AFR yesterday which outlined the reasons behind the head of CBA’s belief that inflation was peaking and the RBA wouldn’t have to hike as aggressively as markets are forecasting:

- Bond markets are targeting the cash rate to rise from 0.35% up to 2.5% in 2022, followed by ongoing rises to 3% through 2023.

- In a contrarian stance CBA are targeting only 1.35% in 2022 followed by normalisation around 1.6% by mid-2023.

Our view at MM is somewhere between these two extremes which in theory should slowly start to add some support to the growth stocks but their downside momentum is increasing and it feels premature to fight it in the near future i.e. every time tech stocks in Australia and the US have shown glimmers of optimism its been snuffed out in very quick fashion. The market is still well above its January lows but for any subscribers who haven’t picked up on our concerns over the last fortnight, we are not planning to move up the risk curve under 7000 this time around. From a general market stance perspective, we remain more comfortable sellers of strength as opposed to buyers of weakness even if the ASX has already dropped 9% in just a few weeks.

Overnight stocks continued to fall although they bounced well off their lows, the Dow finished down -104 points after being more than 600-points lower at its worst. On the sector level, it was a mixed bag in the US with the SPI futures pointing to a flat opening this morning by the Australian market.