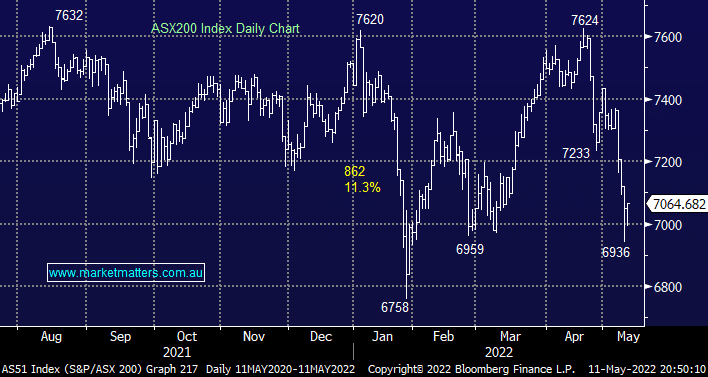

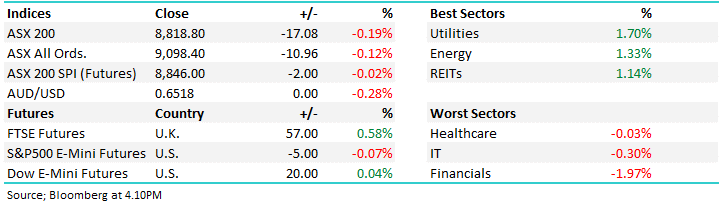

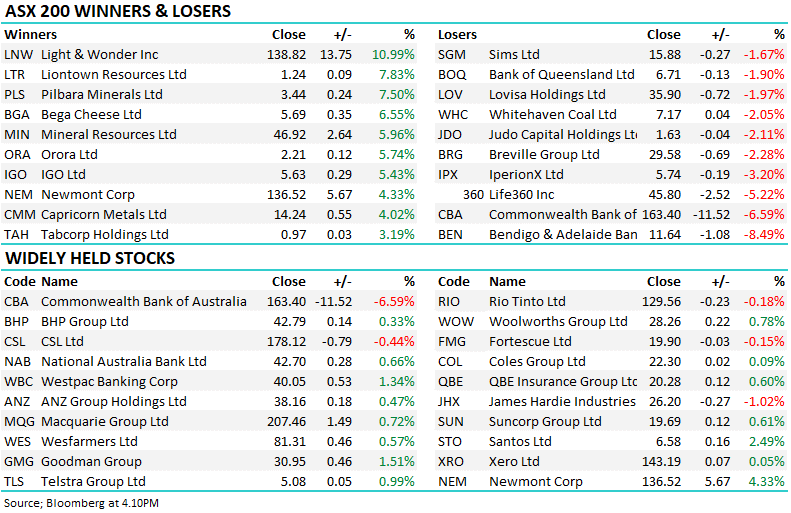

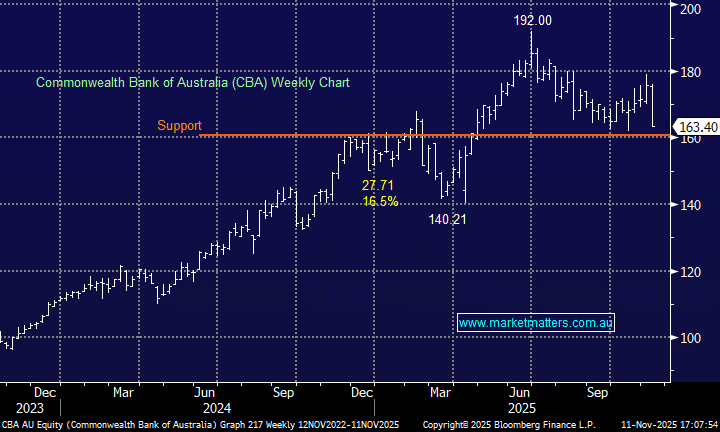

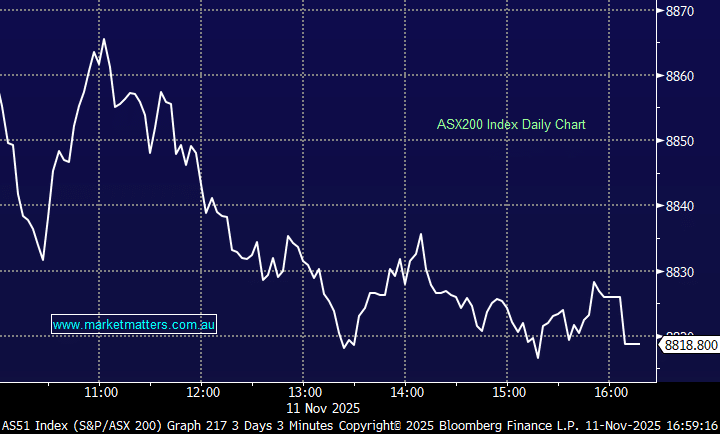

For a second consecutive day, the ASX200 recovered strongly from early morning losses and although the markets still well down for both the week and month it’s finally attracting some bargain hunters into weakness. Ultimately we only saw the market rally +0.2% on Wednesday but it was a solid performance considering National Australia Bank (NAB) and ResMed (RMD) traded ex-dividend plus the overall Banking Sector drifted lower, on the positive side of the ledger the healthcare / real estate stocks finally enjoyed a bounce. Volatility remains the constant so far in 2022 as the index continues to rotate between 6700 and 7650, it’s now 13-months and counting.

- The most recent bounce by the local index in late April was 202-points hence 7150 is likely to become short-term resistance while we believe a close is still required above 7250 to rekindle a bullish bias.

At MM we plan to remain focused on the quality of holdings within our portfolios as the macro-driven gyrations continue in equities, or as we like to say at MM “positioned to sleep” – the easiest way to achieve this goal is through holding excellent businesses that will continue to perform strongly through most economic backdrops. We all know interest rates are going up for the first time in many years hence we need to remain open-minded to what comes next for “risk assets” because it’s been a while since we’ve seen a market more suited to sell the rally as opposed to buy the dip.

The US Fed has been trying to reduce the panic in financial markets with the recent speakers being very measured in their rhetoric, basically saying 0.5% hikes lay ahead as opposed to 0.75%, the US 10-year yield has been unchanged since the 19th of April. While a test of 6750 support almost feels inevitable over the coming months, a short-term bounce appears to be brewing but as central banks embark down an extremely tough path of financial engineering it feels likely that investors will remain unconvinced any time soon that we can avoid a recession – a combination of sharply higher interest rates at a time when economies are slowing is a difficult 1-2 combo.

Overnight, US inflation data led to another session of huge volatility for US stocks which saw the small caps rally 2% earlier in the day before falling away – it feels like they’re looking for a short-term low. US inflation looks set to remain high for a while after CPI came in at 8.3% annualised, above the expected 8.1%, although the rate is now trending lower overall. The numbers sent stocks sharply lower although US bond yields slipped except for the short-dated 2-years as a number of economists now believe peak inflation is already behind us. Overall we believe the statistic doesn’t alter the Feds policy path but it’s likely to help cement further volatility.

By the close, we finally saw the US S&P500 down -1.65% with tech and consumer discretionary stocks leading the declines as interest rates remain front and center in investors’ minds. The SPI futures are pointing to a relatively muted -0.5% drop early this morning back to where the ASX200 was trading at midday yesterday. This morning will be an interesting session to see if the bargain hunters again return into early weakness, our guess is yes but we still believe any decent period of strength will find plenty of sellers.