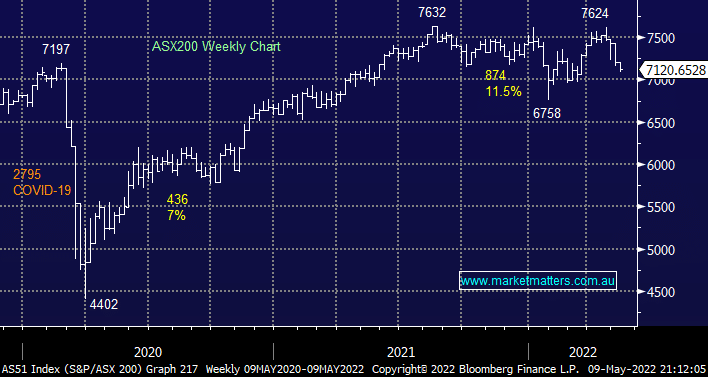

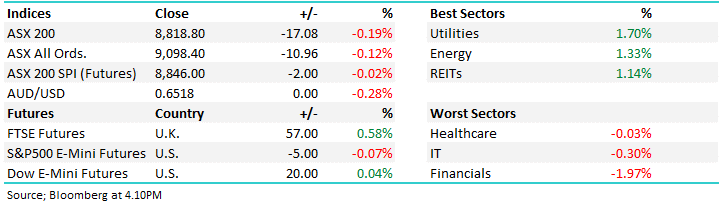

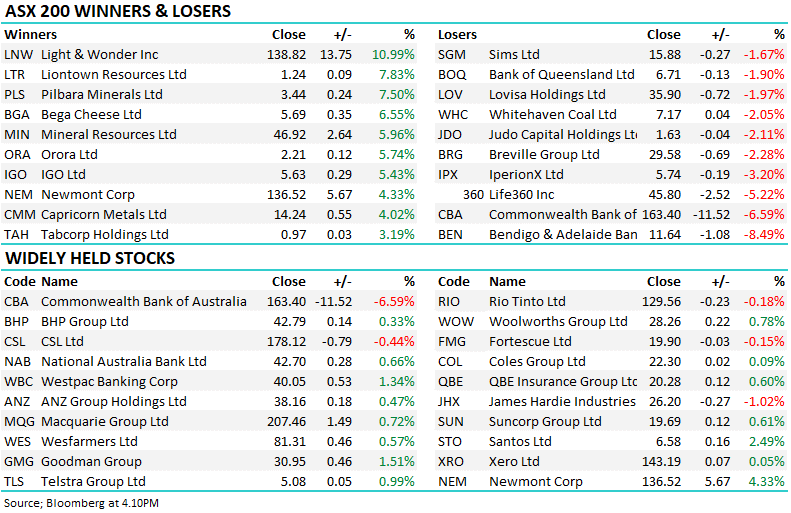

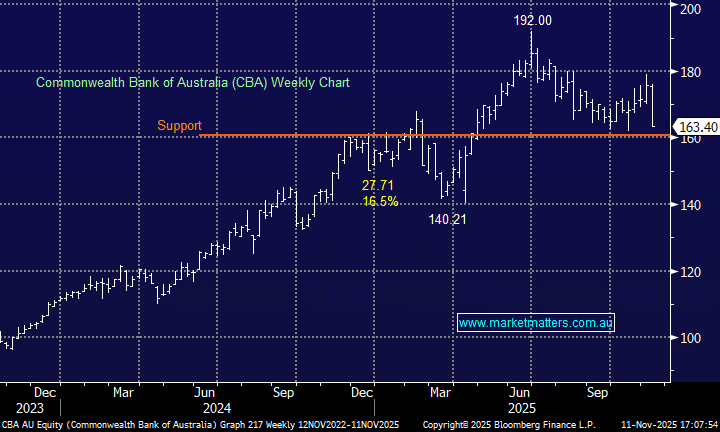

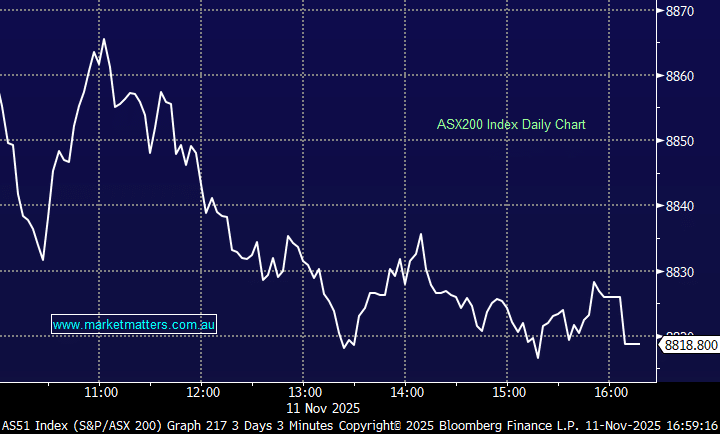

The ASX200 took another tumble on Monday taking Mays decline to well over 4% in just over a week, the selling was again broad based with well over 80% of the main board closing in the red – the “buy the dip” mantra has vanished almost as fast as investors’ appetite for bonds. We are not seeing any fresh trends emerge it’s just a simple continuation of the last 6-months with any stocks trading on high valuations or potentially optimistic future earnings being dumped as investors move increasingly towards defensive names and cash, just a few simple examples from yesterday’s trading sums up the current market sentiment:

Sell Growth: a2 Milk (A2M) -4%, Pilbara Minerals (PLS) -6.2%, Wisetech Global (WTC) -4.9% and Megaport (MP1) -8.6%.

Buy Defensives: TPG Telecom (TPG) +2.3%, CSL Ltd (CSL) +0.8%, Woolworths (WOW) +0.6% and Telstra (TLS) +0.3%.

Identifying solid companies with reliable earnings growth and subsequent dividend flow over the coming years is our key objective at MM but at the moment arguably the most important aspect for adding value to a portfolio over the coming months will be to keep a good handle on the future gyrations of bond yields. The important Australian 10-year yield has already more than doubled in 2022 significantly exceeding the expectations of many bulls including ourselves – while bond yields continue to rally it’s unlikely that much will / can change for stocks. Market killer “stagflation” is now being banded around with belief as opposed to hype which is scary to say the least i.e. the painful economic combination of a recession and rising inflation.

Rising bond yields causes a huge headwind for asset prices from houses to stocks, inventory is already building up in the local housing market which is depressing prices i.e. more properties are coming to market and they are taking longer to sell which is clearly a bad combination for sellers i.e. the “Fear of missing out” has rapidly been transposed from the buyers to the sellers. We Australians have a history of reigning in our spending when housing prices fall, with interest rates rising there’s an increasing likelihood of economic contraction especially with the Ukraine war continuing to push inflation higher – MM expect to hear the recession word more often through 2022 which again will weigh on equities until its starts halting the appreciation in yields.

Overnight we saw US stocks fall to a new 13-month low as any confidence that the Fed could engineer a soft economic landing while taming the inflation tiger vanished in an avalanche of selling. The S&P500 tumbled over 3% with only the likes of supermarkets (Consumer Staples) managing to advance while most stocks saw declines closer to 4%, this morning the SPI Futures are pointing to another -1.4% drop by the ASX200 with BHP Groups (BHP) -3.2% fall in the US likely to weigh on both the Resources Sector and index.