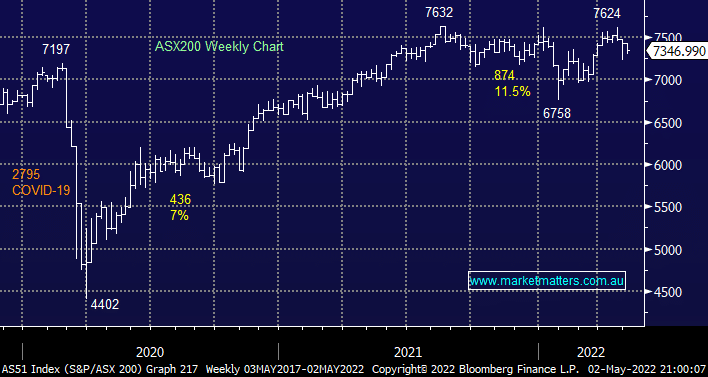

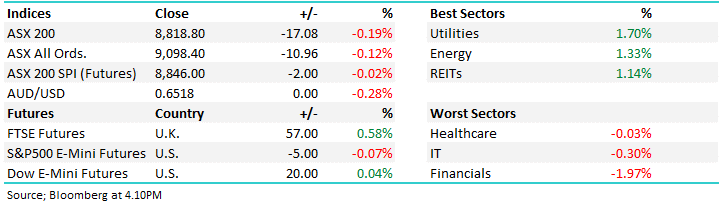

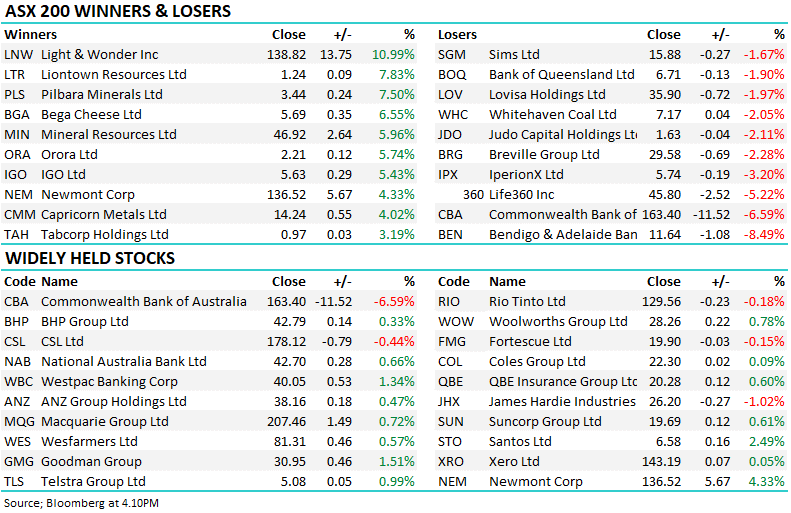

The ASX200 kicked off the infamous May on the back foot slipping -1.2%, overall not a bad performance considering the S&P500 fell over -3.6% on Friday night taking it down over -9% for April, we closed the month basically unchanged. All 11 market sectors declined yesterday and I feel like a broken record stating that the weakness was again focused in the IT Sector as it plunged another 4%, all 14 stocks fell as earnings / valuation jitters took their lead from the US reporting season e.g. Amazon.com (AMZN US) was down -14% on Friday. We’ve been looking for a countertrend bounce from this embattled sector but as we said yesterday “it’s now too early to pre-empt such a move, let’s see if the tape tells us we should be buying this particular dip.”

The media will definitely be focused on the RBA at 2.30pm today, expectations are for a hike from 0.1% to 0.25% with 3 of the big 4 banks flagging the increase which will be the first hike in over 11-years – I’m sure Scott Morrison’s hoping they will act in June but we feel the RBA is already too far behind the curve and will press the button this afternoon. The last time the RBA hiked rates during an election campaign was 15-years ago and the result was John Howard lost his position at the Lodge to Kevin Rudd.

- MM believes the RBA’s “emergency” cash rate of 0.1% is simply ludicrous with inflation rising to levels not seen in over 20-years. i.e. they should have been hiking months ago.

- Also we shouldn’t forget the Feds likely to raise US rates 0.5% on Wednesday night as central banks start following the recent surge by bond yields.

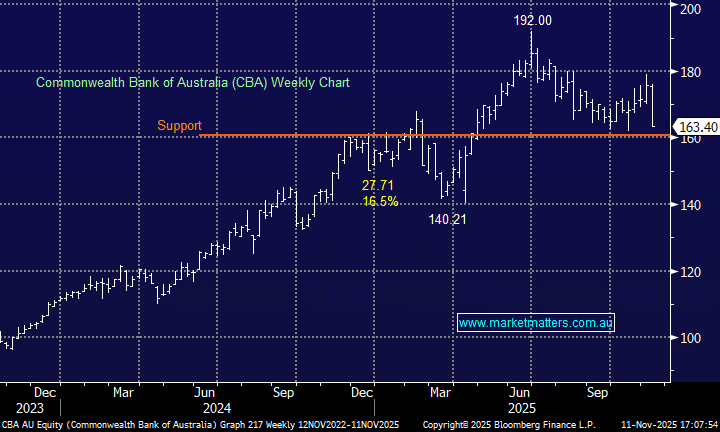

From a markets perspective a rate hike either in May or June is already old news but what the major banks deliver in terms of earnings this week is likely to be as influential on the ASX as the likes of Apple Inc (AAPL US) and Microsoft (MSFT US) have been on the US indices.

- ANZ & NAB report their half-year earnings on Wednesday and Thursday respectively while Macquarie follows with their full-year numbers on Friday.

Overnight we saw US stocks recover some of Fridays fall with a strong +1.7% bounce in tech leading the advance but selling across the commodities and resources names is likely to weigh on the local market this morning with the SPI Futures calling the ASX200 down -0.3% – copper and gold fell -2.9% and -2.6% respectively overnight.

As a side note Citigroup Inc’s trading desk is being blamed for a European flash crash that sent indices across the region spiralling lower following a sudden 8% spike lower by Swedish stocks – technical issues have been ruled out which suggests some resumes might already be in circulation. Unlike here where erroneous trades of that sort are usually cancelled, the trades in Sweden stand. Ouch!