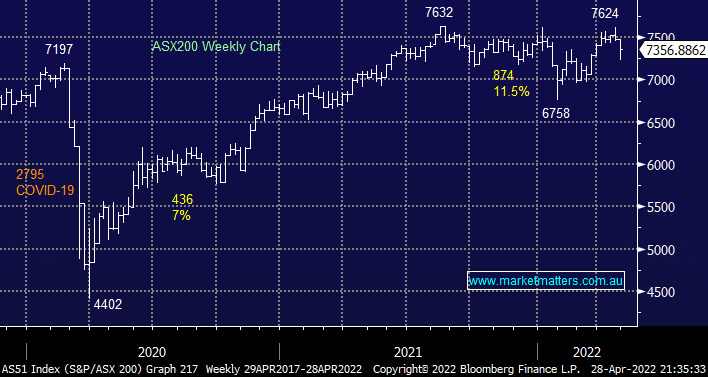

The ASX200 bounced almost +1.3% overnight as the mining stocks enjoyed a strong rebound which helped the Materials Sector rally over +3.5%. The local market yet again finds itself only 3% below its all-time high although most subscribers would agree it doesn’t feel that strong but we cannot argue with the numbers, at MM we still believe “the path of most pain” for underweight investors is a pop to new highs but after trading sideways for more than 12-months it feels a rash call to say it will happen in coming weeks, especially as the banks are starting to feel tired into May.

Markets are moving so fast I would be almost lost without my Bloomberg, when it comes to China and COVID it’s already feeling like old news as stocks shrug off the government introducing lockdown measures in Beijing and Shanghai, that’s just 165 million people being affected! The state’s uncompromising zero case policy is doomed to failure in our opinion but the question that matters remains how much will their stubborn ideals impact the global economy – China is already witnessing unemployment at a 21-month high while President Xi Jinping is calling for an “all-out” infrastructure spend to promote growth but this is hard to execute when the countries locked down!

A number of the Australian resources stocks are looking good but we wouldn’t be chasing any strength for a number of reasons touched on during the week, our investing mantra for 2022 arguably applies the best to the cyclical Materials Sector:

- “Buy on weakness and sell on strength with MM’s bias towards the later for the 1st time in years”.

One sector of the market that’s still refusing to bounce is the Australian Tech Sector which has been hammered over 35% since late 2021, if we could see a reasonable bounce from the likes Xero (XRO) and Altium (ALU) the ASX200 could be trading at all-time highs in the blink of an eye but for now the sectors lost its mojo and remains inundated with players selling every bounce. Unfortunately, the local market has suffered because we simply don’t enjoy the same quality of companies as the US tech sector which is only down 22% e.g. heavyweights Apple (AAPL US) and Microsoft (MSFT US) are holding up extremely well when we consider how hard they’ve run post-COVID.

Overnight we saw US stocks surge the most in 7 weeks as earnings optimism returned to investors almost as quickly as it left with elevated volatility remaining the clear constant. This time we saw Meta Platforms (FB US) +18%, PayPal (PYPL US) +10% and Qualcomm Inc (QCOM US) +10%, to put things into perspective the average swing by stocks through the current reporting season is the highest in well over a decade although with such the macro factors as looming rate hikes, a Russian invasion of the Ukraine and Chinese COVID lockdowns exacerbating the risks of a recession it’s no great surprise. The S&P500’s rally of +2.5% is helping the SPI Futures point to an opening this morning back above 7400 for the ASX200.