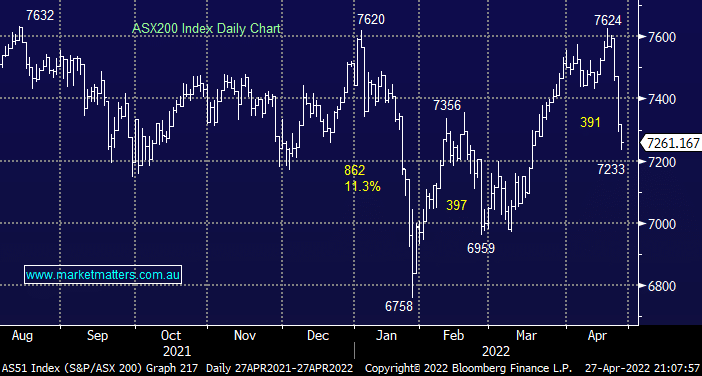

A week is proving to be a very long time in today’s market, last week the ASX200 tested its all-time high for a second time in 2022 and then yesterday morning we found ourselves 5% lower. The pullback has largely been driven by a plunge in the previously “hot” Resources Sector as China threatens to choke the global economy with further COVID lockdowns, over just 6 trading sessions heavyweight BHP Group has fallen 16%. While MM believes the sector is likely to attract some buying after its savage rerating we remain conscious that investors were positioned the most overweight ever towards the commodity sector which by definition poses some clear washout risks – time will tell if we’ve just witnessed enough of a sell-off to rebalance the markets positioning towards the sector however it seems a strong possibility.

Interestingly the local index has now experienced its second 390-400 point pullback of the year, technically we see no exciting risk /reward opportunities in either direction for the ASX200 as the index basically sits in the middle of its 13-month trading range between 6750 and 7625 i.e. all the action is unfolding under the hood of the market on both the stock and sector level. The one consistent over the last 12-18 months is when the market decides to throw a stock/sector into the proverbial “naughty corner” the moves have been both sharp and swift e.g. selling of many tech & resource names at various stages over recent months. We are seeing moves that look like a multi-month/year cyclical change in trend unfolding in just a couple of volatile weeks, arguably the characteristic of an unhealthy market.

MM has subsequently refocused our attention on the defensive end of town today as market jitters increase by the day thanks to the multitude of macro headwinds that continue to build:

- After yesterday’s highest inflation print in over 20-years the RBA looks set to raise interest rates next Tuesday, it’s been coming for a while but the first hike in almost 12-years now feels imminent.

- Over the last fortnight China has scarred the financial world as it considers locking down Beijing which could easily send the global economy into reverse.

- Global bond yields have been surging through 2022 leading to a major rerating of the high valuation growth stocks with tech the worst hit.

- The world is still struggling with supply chain constraints which are being magnified by the uncertainty around the awful conflict in Ukraine.

Overnight we saw US stocks experience a mixed session with the S&P500 closing up +0.2% with a further bounce in energy stocks supporting the index, while a likely further +2% bounce in BHP has helped SPI futures add around 50 points which point to an open around 7300 by the ASX200,