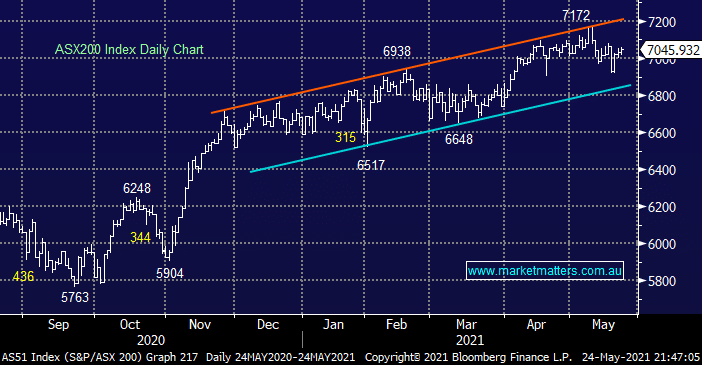

The ASX200 shrugged off some initial morning jitters to commence the week on the front foot rising +0.2% with strength in the banking sector more than offsetting losses in the heavyweight miners e.g. Commonwealth Bank (CBA) and National Australia Bank (NAB) each rallied +0.7%, while OZ Minerals (OZL) and Fortescue Metals (FMG) both fell by over -4%. The local market received a helping hand from the US futures which rallied solidly during our day session after dipping on the opening, a recovery which felt like it lifted a weight off the ASX.

The growth stocks continue to regain their mojo and while healthcare outperformed IT yesterday the later still enjoyed 4 names rallying by more than 2%, impressively over half of the local IT sector has now rallied by more than 5% during the last 5-days while the index simply treads water. Our preference is bond yields drift lower over the next few months which should act as a tailwind for the sector, we anticipate increasing our tech exposure if we see another dip lower, especially if its courtesy of weakness caused by the US FAANG’s.

We have covered the potential dip in the resources sector over the last few weeks and we feel the miners topped out 2-weeks ago amongst a crescendo of positive press, as is so often the way. In rapid fashion we’ve seen some meaningful pullbacks from the big end of town such as BHP Group (BHP) -10%, RIO Tinto (RIO) -10.3% and OZ Minerals (OZL) – 10.4%. Sabre rattling by China with regard to commodities and especially iron ore imports doesn’t help but we simply believe too many investors boarded the resources express creating a crowded position – MM remains bullish the reflation trade but another 8-10% downside by the sector wouldn’t surprise us over the coming weeks / months.

NB MM is cashed up hence we are wearing our buyers hat at present which explains our focus on levels to accumulate stocks / sectors we like.

Overnight US stocks were again led higher by a strong tech sector which gained almost 2% with all the big names enjoying gains, the positive lead helped the broader S&P500 close up +1.1% already closer to its all-time high than last week’s low. The SPI futures are calling the ASX200 up another +0.3% this morning back towards 7100 as last week’s dip below 7000 almost feels like a memory.