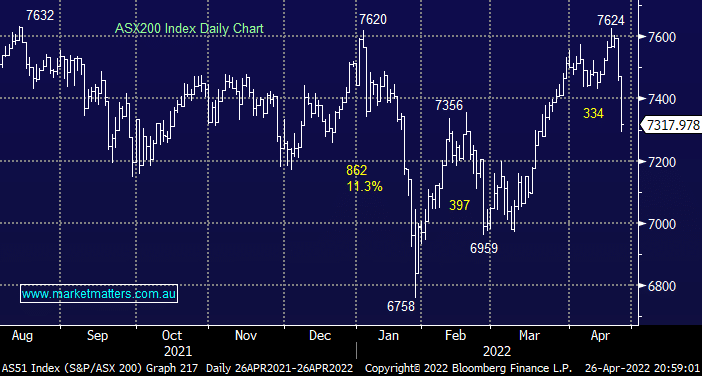

The ASX200 tumbled 2% yesterday courtesy of the combination of gathering downside momentum in global equities and China’s deteriorating COVID picture which is seriously threatening to derail global growth as lockdowns loom across the world’s 2nd largest economy. China is following the rest of the world’s approach to COVID elimination only more than a year behind schedule, Xi Jinping et al are now considering locking down Beijing in an effort to follow their zero-tolerance policy towards the virus – good luck with that! The “million-dollar question” is how far will China go to fight COVID and what will be the impact on both their and the global economy, unfortunately, history tells us that once they start down a particular path the dictatorship usually is a stubborn/unrelenting beast.

The relative performance of the ASX has been turned upside down over the last few days as commodity prices accelerate lower from their extreme highs following Russia’s invasion of Ukraine e.g. just since last week’s highs many major stocks have already corrected significantly: BHP-15%, OZ Minerals OZL) -16%, South32 (S32) -19% and Woodside (WPL) -10%. MM had migrated away from the Resources Sector during the panic buying in March, hopefully, we will see similar price action on the downside to enable us to acquire some bargains – we already nibbled at Woodside (WPL) yesterday.

- A Chinese led global slowdown is the worst possible scenario for commodities such as oil and copper and by definition sector-related stocks will follow – the ASX is set to struggle as over a quarter of its market cap is materials & energy stocks.

- The looming Chinese slowdown macro headwind is significantly compounded by investors being the most overweight ever the commodity sector i.e. a panic exodus could rapidly become ugly but an opportunity for the prepared.

Overnight we saw US stocks fall to a 6-week low ahead of key reports from the likes of Microsoft (MSFT US) and Alphabet (GOOGL US) as concerns grow that corporate profits won’t be able to withstand aggressive interest rate hikes by the Fed. The Dow finally closed down over 800-points with the SPI futures pointing to another 3-figure loss by the local index, the Energy Sector was the pocket of green on the US bourse which should at least help our purchase of Woodside (WPL) yesterday, elsewhere on the resources front BHP Group (BHP) is set to drop over 1% to test $45 early this morning.

Inflation data due out at 11.30 am this morning will be worth watching, the market pricing a headline rate of 4.6% YoY.