Before getting in to todays note, I must mention the passing of Bob Fulton, a legend of Rugby League and a Manly great. RIP Bob Fulton. Manly certainly turned it on against Parra on Sunday and now look real contenders, in my humble opinion.

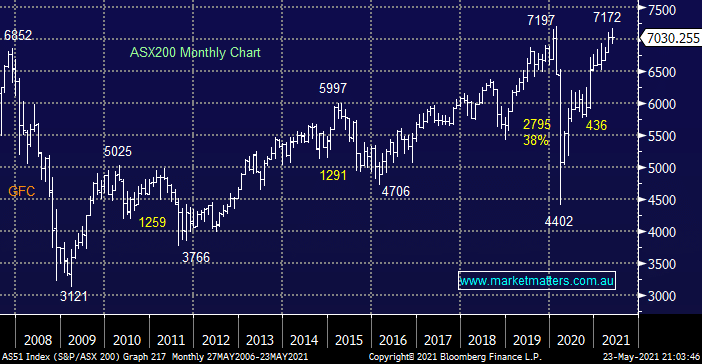

After over 3-weeks, May has delivered very little on the index level with the ASX200 up just 5-points month to-date, coincidentally the exact amount the SPI futures are calling the index to fall on the open this morning. All the action continues to unfold beneath the hood with 17% of the index falling by more than 10% while only 6% has rallied by the same degree, however when heavyweight Commonwealth Bank (CBA) is in the winners enclosure it skews the data somewhat – the core takeout being the broad market is not as healthy as the surface numbers suggest.

The respective sector performance over last year has been governed by an aggressive economic recovery and by association global bond yields which has seen investors flock to the reflation / value stocks at the expense of the growth names, a rotation which has been particularly pronounced in the Australian market – the RBA official interest rate may remain unchanged at 0.1% but the 10-year bond yield has more than tripled from 0.55% to test over 1.9%. Our view over the coming months hasn’t floundered although it still feels a 50-50 call whether the markets have reached their point of inflection:

- MM is looking for at least a few more months sideways / lower from bond yields, this supports our theory that many Australian IT stocks which have endured an awful time in 2021 are looking for a low, one which they may have already found.

- We are also looking for a recovery in the $US although a washout to fresh 2021 lows is another 50-50 call but importantly this suggests it’s way too late to be chasing the resources sector which have enjoyed a strong 2021 to-date, we feel better opportunities will present themselves further down the track.

I will look again at both of the these critical points today and over the weeks ahead as they will influence the weightings across MM’s respective portfolios. I hate to sound like a broken record but when the major markets don’t move for a number of weeks it’s a dangerous pursuit to push too many ideas / thoughts onto the market, we prefer to remain focused on what we believe are the underlying determining factors.

Friday night delivered a mixed session for the US market which saw the tech names slip lower while the financial s & healthcare stocks rallied, the net impact on our SPI Futures is they’re looking for the ASX to open marginally lower.