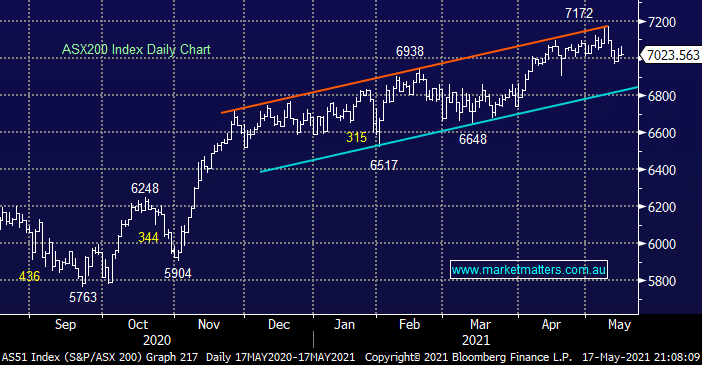

Yesterday saw the ASX200 fail to hold onto most of its early gains as the “sell the bounce” mentality continues to surface, the local market ended the day on its session lows up just 0.1% with winners and losers pretty evenly matched. There was some noticeable buying in the IT, Energy & Gold Sectors while the wooden spoon went to the Telco’s and Utilities, the polarisation was actually more apparent on the stock level e.g. in the IT Sector we saw Xero (XRO) rally +5.6% while half of the 14 stocks in the group actually fell.

Corporate profits are currently booming leading to increased stock buybacks and presumably elevated dividends / special dividends through the remainder of 2021 e.g. Commonwealth Bank (CBA) rallied to fresh all-time highs yesterday in anticipation of future returns for shareholders, the major Australian banks are currently sitting on a whopping ~$30bn of excess cash thanks to aggressive provisioning during COVID. However its not all good news as almost panic buying is creating havoc in many supply chains, just go and see the ever increasing wait time for a new car in Australia. This enormous demand has sent the Baltic Dry Index (shipping costs) to an 11-year high creating subsequent significant bottlenecks in delivery of goods, simple 101 economics of supply & demand says its inevitably going to push prices & inflation higher.

Subscribers know that we believe inflation and interest rates are going higher medium-term which will determine which stocks / sectors produce the best performance however we mustn’t underestimate the Feds resolve to keep rates lower for longer, even if they have a limited number of levers left to pull. If we were to simply articulate our outlook for stocks through 2021 / 22 its central banks will maintain the markets confidence supporting stocks into pullbacks this year but its going to become increasingly tough moving forward and we anticipate MM’s portfolios to be largely devoid of stocks which are likely to significantly hampered by rising interest rates over the medium to longer term. Interesting to note this morning in my UBS research pack that their economic strategist is talking for the first time about RBA tapering and earlier rate hikes than the 2024 timeframe they’ve been guiding to.

MM remains “cashed up” and looking for buying opportunities over the coming months however as we saw with carsales.com (CAR) yesterday we aren’t adverse to targeting bargains on the individual stock / sector level if they unfold before the underlying index reaches our target area.

Overnight US stocks were mixed with the tech based NASDAQ leading the losses falling -0.6% as bond yields edged higher however the major indices did manage to reclaim ~60% of their early losses and the SPI futures are pointing to small gains early today on the back of soaring commodity prices, heavyweight BHP is set to open up almost 2% while Gold stocks should also rally.