Yesterday saw the ASX200 fall another 52-points testing the psychological 7000 area in the early afternoon, the worm certainly hasn’t turned yet but there’s definitely some cracks forming in some global indices and local sectors. Over 75% of stocks fell on the day but with Commonwealth Bank (CBA) popping to fresh 6-year highs the losses were limited to less than 1%. On the sector level it was a day of reversion with the tech stocks best on ground while the energy and “yield play” names both fell over 2%.

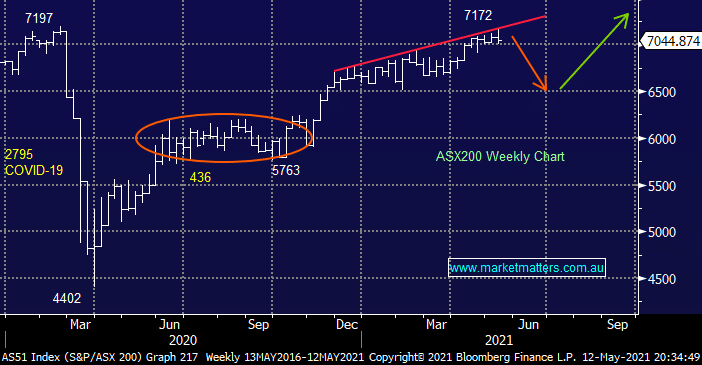

The market did feel well supported towards the day’s lows and even while our preferred scenario is the index corrects 6-8% through May and June it’s important to remember we are looking for a pullback to buy, not a significant change in trend hence reasonable decent intra-day recoveries similar to yesterday are to be expected. MM still believes the main game in town will continue to be stock & sector rotation with the $US and bond yields likely to continue determining the best performers through 2021.

Following this week’s budget understandably the travel & tourism sector struggled with the likes of Sydney Airports (SYD) and Flight Centre (FLT) both falling close to 5% – MM still believes it’s too early to be looking for bargains amongst these lockdown sufferers but their day will come. Surprisingly the retailers slipped lower even as many Australians will be considering the extra incentives to spend, especially small businesses. Conversely the building stocks embraced some of Josh Frydenberg’s stimulus with both CSR Ltd (CSR) and Boral (BLD) rallying strongly through the weak session.

Overnight US stocks continue to cascade lower with the Dow falling almost 700-points but it was the tech stocks that again led the declines with the NASDAQ retreating -2.6%. The SPI futures are appearing resilient this morning only calling the ASX200 to again test the 7000 support area early in today’s session, BHP rallying 25c in the US is likely to be fuelling the optimistic sentiment.