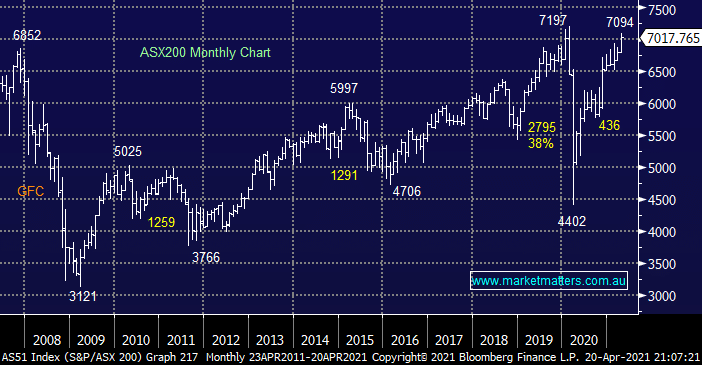

The ASX200 had a bad day at the office yesterday underperforming most global indices as nerves appeared to flicker across investors headlights – the local indexes largest decline in April unfolded courtesy of some broad based selling which saw over 65% of stocks fall while on the sector level only the Telcos closed in positive territory. Our preferred scenario is the local market ultimately tests its 2021 low in the 6500 area but a 7-8% fall still feels a big ask in today’s market.

It continues to amaze me that financial markets are still ignoring the deteriorating COVID news e.g. today Tokyo announced it was considering another state of emergency as cases surge just 100-days before the Olympics are due to commence. The Japanese Nikkei fell less than 2% illustrating the prevailing “buy the dip” mentality which has prevailed over the last 12-months. MM believes this will repeat but the dip might be deeper than many anticipate especially if the virus news continues to worsen.

The wealth effect has continued unabated through 2021 as luxury car sales boom and property prices rally, the only thing suffering is the overseas holiday i.e. at this stage the RBA is clearly winning as lower interest rates are leading to increased discretionary spending. As we all know from bond yields the elastic band can stretch far further than many believe possible, who would have considered a decade ago that negative bond yields would be commonplace across the world. At this stage we feel the greatest risk for stocks is within the travel sector as COVID fails to disappear yet optimism is everywhere e.g. Corportae Travel (CTD) and Flight Centre (FLT) have recovered 110% and 78% respectively in just 12-months.

Overseas equities closed lower overnight with most US indices down around -0.7%, however with the financials falling -1.7% its no surprise to see the SPI calling the ASX200 down over 1% this morning, suddenly were closer to 6900 than 7000!